When winter weather strikes, drivers face out-of-the-ordinary challenges when they get behind the wheel. Snow, slush or icy roads are involved in nearly one in four weather-related vehicle crashes. These conditions can make it harder for drivers to see, slow down and stop – all factors that can increase the chances of an accident.

If you must travel during winter weather, preparing your car in advance, knowing the forecast and driving based on road conditions are three key ways to help you drive more safely. Following are some winter driving safety tips to help you prepare for the elements – before you face them – on the road.

Preparing Your Vehicle

As temperatures start to drop, it’s time to make sure your car is stocked with a winter driving survival kit, including an ice scraper, a snow shovel and sand or road salt. This way, you’ll be prepared if winter weather arrives while you’re away from home. It’s also a good time to check your tires to determine whether it’s time to replace them or whether you need snow tires.

A few habits to adopt regularly during the winter months can also help prepare you for a wintry drive. Keep your windshield wipers in good condition and your windshield fluid reservoir filled so you can clear snow and ice from your windshield. Make it a practice to keep your gas tank full so you can run your engine and stay warm if you get stuck or stranded.

Keeping your gas tank full in extended cold weather can also help minimize the amount of water vapor in your tank, which can freeze when temperatures drop. In addition to keeping the tank full, consider keeping your vehicle in a garage and using fuel additives such as dry gas to help eliminate water vapor that could freeze in your gas lines. You should also either drive or run your car in a well-ventilated area at least every few days to help avoid a dead battery, another cold weather concern.

Watching the Weather

If you plan to travel when inclement weather looms, monitor road and weather conditions by checking local news stations or Internet traffic and weather sites. You can sign up for weather alerts to receive text messages and optional alerts for your area. Do not check your phone while driving and avoid all unnecessary distractions when you’re behind the wheel.

Driving for Winter Conditions

Before you leave the driveway or parking lot, take time to clear snow and ice off your car, including your windows, mirrors, lights, reflectors, hood, roof and trunk. Drive with your headlights on and be sure to keep them clean to improve visibility. Use caution when snow banks limit your view of oncoming traffic.

As you get on the road, remember that speed limits are meant for dry roads, not roads covered in snow and ice. You should reduce your speed and increase your following distance as road conditions and visibility worsen. Avoid using cruise control in snowy or icy conditions – you want to have as much control over your car as possible. Be cautious on bridges and overpasses as they are commonly the first areas to become icy. Avoid passing snow plows and sand trucks because the drivers may have limited visibility and the road in front of them could be worse than the road behind.

Breaking Down or Getting Stuck

If you are unexpectedly caught in a snowstorm and are stranded or get stuck in snow, if your car is safely out of harm’s way, stay in your car and wait for help. You can run the car heater to stay warm for 10 minutes every hour, but first, make sure your exhaust pipe is clear of snow. There is a danger of carbon monoxide poisoning if snow blocks the pipe and enables the deadly gas to build up in your car. Open your window slightly to help prevent any buildup.

Remember, driving in winter weather can be challenging, even for experienced drivers. Slowing down, allowing increased time to come to a stop, wearing your seatbelt, devoting your full attention to the road and being aware of changing conditions can help you drive more safely. If your travel route takes you into remote areas with limited cell phone coverage, consider informing a third party of your travel plans and share with them your route and when you plan to arrive. This way, if you are overdue, first responders will know where to start looking. If you’re unsure whether it is safe to drive, consider waiting until the roads improve.

Source:

https://www.travelers.com/resources/auto/safe-driving/winter-driving-safety-tips

FAQs: Commercial Auto Insurance – Sara and Allison review the basics of the commercial automobile coverage and some related FAQs.

August 2021: Topics include COVID-19, fall semester, biometric risks, severe weather & transportation risks.

July 2021: Topics include transportation risks, wildfires, mental health, & COVID-19.

Non-Owned Automobile Liability is the most commonly misunderstood coverage in the Sorority Book of Business. Non-Owned Automobile Liability is designed to protect the organization for the risk of being named in a lawsuit involving an automobile. It does not protect individuals who are driving on behalf of the Sorority/Fraternity.

Non-Owned and Hired automobiles are automatically covered under the organization’s Automobile Liability policy and are defined as follows:

Hired Autos: Autos you lease, hire, rent or borrow; except autos from your employees and members (for example, vehicles you rent from Avis, Hertz, etc.). When you are renting an automobile on behalf of the organization, there is no need for you to purchase the physical damage coverage for the automobile from the rental car company. Hired Automobile Physical Damage coverage is provided subject to the policy deductibles.

Non-owned Autos: Autos you do not own, lease, hire, rent or borrow that are used in connection with your organization. This includes autos owned by your employees and members but only while used in your organization. Provides coverage for sums you legally must pay as damages because of bodily injury or property damage caused by an accident and resulting from the use of a covered auto.

It is important to note that the Hired Automobile Physical Damage coverage extends to direct damage or theft of a rented automobile and operates for the benefit of the insured, which is the fraternity/sorority. Automobile rental agreements, therefore, should always be executed in the name of the fraternity/sorority, rather than an individual’s name.

Any Named Insured using a non-owned or hired auto is an insured, except:

- The owner or anyone else from whom you hire or borrow a covered auto.

- Your employee – if the covered auto is owned by that employee or a member of his/her household.

Non-Owned Automobile Liability coverage does not provide coverage for someone who is driving their personal automobile to or from Sorority/Fraternity events. This coverage is designed only to protect the organization, not the volunteer, member, officer, etc. who is driving their own vehicle on the organization’s behalf. Any volunteers, members, officers, etc. who choose to drive their personal automobiles on behalf of the organization need to rely on their own personal automobile coverage in case of an accident.

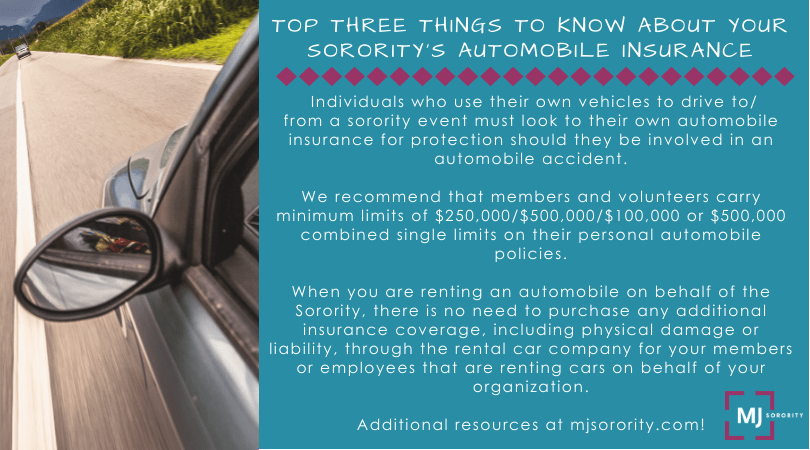

Individuals who use their own vehicles to drive to/from a sorority event must look to their own automobile insurance for protection should they be involved in an automobile accident.

The exposures associated with the Non-Owned Automobile Liability coverage are particularly concerning from a risk management perspective because of the vast number of personal automobiles that are driven to and from Sorority/Fraternity events at any given time that expose the organization to a Non-Owned Automobile Liability claim.

Further exacerbating the sheer exposure issue with non-owned autos is the number of members, volunteers and third-party individuals who only carry the state minimum automobile liability limits, which are woefully inadequate for accidents involving even minor injuries. For their own protection and fiduciary stability, we recommend that all volunteers and members of your organization carry at least a combined single limit of $300,000. Higher automobile liability limits are marginally more expensive than the state minimum limits, and the higher the limit, the less likely you are to suffer long-term financially consequences to an automobile accident.

Even in situations in which the organization was not negligent in causing the accident, plaintiff attorney’s often use the “deep pocket” mentality when it comes to automobile accidents involving even minor injuries, meaning that the Sorority/Fraternity is seen as the “deep pocket” in the situation. Accordingly, in many of the examples listed below, the organization was brought into the lawsuit because they were seen as having more money and/or higher insurance limits to pay for the cost of lengthy litigation and judgment.

Over the last ten years, under the MJ Sorority Book of Business, the insurance company has paid out over $3.7M in automobile-related claims on behalf of our clients. With the potential for one accident (see examples below) to wipe out ten or more year’s worth of an organization’s Non-Owned Automobile Liability premium, the non-owned automobile exposure is quite disturbing.

Clearly the Non-Owned Automobile Liability exposure is an uncontrollable one, which is what makes it so concerning for our clients. The most important risk management tool in attempting to limit your Non-Owned Automobile Liability exposure is to encourage your members and volunteers to have a minimum combined single personal automobile liability limit of $300,000. In addition, we do not support designated driver programs that are not held in conjunction with an official sorority event (see this position paper on our website for more information). Finally, it is important that the chapter and sorority/fraternity leadership educate their members and volunteers as to how this coverage operates, so that they are aware of the exposure to their personal insurance coverage when they drive to/from any sorority/fraternity event or activity.

The following claim examples are real-life examples of how the Non-Owned/Hired Automobile Liability coverage responds when an incident occurs:

Example #1

Several chapter members were driving to a regional conference together in a member’s personal automobile. The vehicle swerved off the interstate in a single-vehicle accident, and one of the chapter member occupants was killed and another chapter member occupant was severely injured. The families of the killed and injured chapter members sued the driver and the Sorority for damages. The driver of the vehicle only carried the state minimum insurance limit of $25,000, which were quickly exhausted. The organization’s insurance policy settled with both families for a total of $740,000. The sorority was brought into this lawsuit because the driver’s limits were so low and the families of both women felt that someone (i.e. the Sorority) should pay for their loss. In addition, the Sorority’s policies stated that sisters driving vehicles in “official sorority capacity” were doing so as agents of the Sorority, which further hurt the Sorority’s defense.

Example #2

An officer was involved in an automobile accident in a rental car while attending a Leadership Conference. The officer failed to yield the right-of-way in traffic and struck another vehicle, injuring the two passengers in the other vehicle. The insurance company, on behalf of the organization, paid out $252,000 in settlement to the claimant and defense costs and $13,000 in property damages to the rental car company. The insurance company, on behalf of the organization, settled this claim because the officer was driving a rental car, and all cars rented for sorority purposes are covered under the insurance policy.

Example #3

A chapter advisor was driving a few members to the chapter house after a philanthropic event in her personal automobile. She ran a red light and severely injured two people riding on a motorcycle. The advisor’s personal automobile insurance limit was only $100,000, which was exhausted immediately. The total cost of the claim was $2,385,000. The insurance company settled this claim on behalf of the organization because of the deep pocket theory. In addition, the insurance company was unwilling to take the claim to court and risk the jury ruling in favor of two young people with severe injuries

Non-Owned Automobile Liability is the most commonly misunderstood coverage in the Sorority Book of Business. Non-Owned Automobile Liability is designed to protect the organization for the risk of being named in a lawsuit involving an automobile. It does not protect individuals who are driving on behalf of the Sorority/Fraternity.

Non-Owned and Hired automobiles are automatically covered under the organization’s Automobile Liability policy.

Hired Autos: Autos you lease, hire, rent or borrow; except autos from your employees and members (for example, vehicles you rent from Avis, Hertz, etc.). When you are renting an automobile on behalf of the organization, there is no need for you to purchase the physical damage coverage for the automobile from the rental car company. Hired Automobile Physical Damage coverage is provided subject to the policy deductibles.

Non-owned Autos: Autos you do not own, lease, hire, rent or borrow that are used in connection with your organization. This includes autos owned by your employees and members but only while used in your organization.

Provides coverage for sums you legally must pay as damages because of bodily injury or property damage caused by an accident and resulting from the use of a covered auto.

It is important to note that the Hired Automobile Physical Damage coverage extends to direct damage or theft of a rented automobile and operates for the benefit of the insured, which is the fraternity/sorority. Automobile rental agreements, therefore, should always be executed in the name of the fraternity/sorority, rather than an individual’s name.

Any Named Insured using a non-owned or hired auto is an insured, except:

- The owner or anyone else from whom you hire or borrow a covered auto.

- Your employee – if the covered auto is owned by that employee or a member of his/her household.

Non-Owned Automobile Liability coverage does not provide coverage for someone who is driving their personal automobile to or from Sorority/Fraternity events. This coverage is designed only to protect the organization, not the volunteer, member, officer, etc. who is driving their own vehicle on the organization’s behalf. Any volunteers, members, officers, etc. who choose to drive their personal automobiles on behalf of the organization need to rely on their own personal automobile coverage in case of an accident.

Individuals who use their own vehicles to drive to/from a sorority event must look to their own automobile insurance for protection should they be involved in an automobile accident.

The exposures associated with the Non-Owned Automobile Liability coverage are particularly concerning from a risk management perspective because of the vast number of personal automobiles that are driven to and from Sorority/Fraternity events at any given time that expose the organization to a Non-Owned Automobile Liability claim.

Further exacerbating the sheer exposure issue with non-owned autos is the number of members, volunteers and third-party individuals who only carry the state minimum automobile liability limits, which are woefully inadequate for accidents involving even minor injuries. For their own protection and fiduciary stability, we recommend that all volunteers and members of your organization carry at least a combined single limit of $300,000. Higher automobile liability limits are marginally more expensive than the state minimum limits, and the higher the limit, the less likely you are to suffer long-term financially consequences to an automobile accident.

Even in situations in which the organization was not negligent in causing the accident, plaintiff attorney’s often use the “deep pocket” mentality when it comes to automobile accidents involving even minor injuries, meaning that the Sorority/Fraternity is seen as the “deep pocket” in the situation. Accordingly, in many of the examples listed below, the organization was brought into the lawsuit because they were seen as having more money and/or higher insurance limits to pay for the cost of lengthy litigation and judgment.

Over the last ten years, under the MJ Sorority Book of Business, the insurance company has paid out over $3.7M in automobile-related claims on behalf of our clients. With the potential for one accident (see examples below) to wipe out ten or more year’s worth of an organization’s Non-Owned Automobile Liability premium, the non-owned automobile exposure is quite disturbing.

Clearly the Non-Owned Automobile Liability exposure is an uncontrollable one, which is what makes it so concerning for our clients. The most important risk management tool in attempting to limit your Non-Owned Automobile Liability exposure is to encourage your members and volunteers to have a minimum combined single personal automobile liability limit of $300,000. In addition, we do not support designated driver programs that are not held in conjunction with an official sorority event (see this position paper on our website for more information). Finally, it is important that the chapter and sorority/fraternity leadership educate their members and volunteers as to how this coverage operates, so that they are aware of the exposure to their personal insurance coverage when they drive to/from any sorority/fraternity event or activity.

The following claim examples are real-life examples of how the Non-Owned/Hired Automobile Liability coverage responds when an incident occurs:

Example #1

Several chapter members were driving to a regional conference together in a member’s personal automobile. The vehicle swerved off the interstate in a single-vehicle accident, and one of the chapter member occupants was killed and another chapter member occupant was severely injured. The families of the killed and injured chapter members sued the driver and the Sorority for damages. The driver of the vehicle only carried the state minimum insurance limit of $25,000, which were quickly exhausted. The organization’s insurance policy settled with both families for a total of $740,000. The sorority was brought into this lawsuit because the driver’s limits were so low and the families of both women felt that someone (i.e. the Sorority) should pay for their loss. In addition, the Sorority’s policies stated that sisters driving vehicles in “official sorority capacity” were doing so as agents of the Sorority, which further hurt the Sorority’s defense.

Example #2

An officer was involved in an automobile accident in a rental car while attending a Leadership Conference. The officer failed to yield the right-of-way in traffic and struck another vehicle, injuring the two passengers in the other vehicle. The insurance company, on behalf of the organization, paid out $252,000 in settlement to the claimant and defense costs and $13,000 in property damages to the rental car company. The insurance company, on behalf of the organization, settled this claim because the officer was driving a rental car, and all cars rented for sorority purposes are covered under the insurance policy.

Example #3

A chapter advisor was driving a few members to the chapter house after a philanthropic event in her personal automobile. She ran a red light and severely injured two people riding on a motorcycle. The advisor’s personal automobile insurance limit was only $100,000, which was exhausted immediately. The total cost of the claim was $2,385,000. The insurance company settled this claim on behalf of the organization because of the deep pocket theory. In addition, the insurance company was unwilling to take the claim to court and risk the jury ruling in favor of two young people with severe injuries.

Example #4

A chapter member’s personal automobile was vandalized during the middle of the night in the chapter’s parking lot. The member’s personal automobile policy will need to pay for the repairs because the organization was not negligent in causing the damage, and the member had signed the housing agreement, which holds the organization harmless when personal property is damaged. The organization’s Non-Owned Automobile Liability does not cover property damage to individual’s personal automobiles.

Example #5

A “sober sis” program on a random Friday night led to a claim that cost the organization and the automobile driver’s family nearly $1M. For more information, check out our Position Paper on Sober Sis/Designated Driver programs. A chapter-sponsored “sober sis” program implies that the chapter will put in place proper safety guidelines and have some control over the transportation safety; however, the chapter has little control over an individual driving their personal vehicle and has even less control over the other drivers on the road.

Check out the Insurance Summary for more detailed information about your organization’s automobile policy, but the below graphic has the top three things to remember:

Here is a print-friendly PDF version.

We have all encountered scenarios in which other drivers make us shake our heads. People often are quick to accuse other drivers of being reckless, but if pressed, they may admit to sometimes driving recklessly themselves. If unsafe driving is everyone’s problem, what is the solution?

Our safety professionals have put together three tips that can help make sharing the road safer while getting from point A to B.

Assume You are Invisible

It can be easy to assume everyone else on the road is paying attention, following traffic laws, and can see you clearly. However, that is not always the case. Next time you are expecting another driver to respect your right-of-way or let you merge into another lane, do not assume they are on the same page.

Avoid Competitive Driving

Whenever you are on the road, resist the urge to drive competitively. Instead, go with the flow and drive defensively. See yourself as part of a community of drivers – all trying to get to your destinations safely. Your improved driving behavior may rub off on others and help create safer conditions for everyone on the road.

Control Your Emotions

It may be easy to react to aggressive driving by becoming aggressive yourself. But taking the high road is often the best route. Someone cuts you off? Take a deep breath and just let it roll off your back.

Here are some ways to help prevent your emotions from getting the best of you on the roadway:

- Be patient when traffic delays slow you down.

- Keep a safe following distance behind other vehicles. You never know when someone may stop short.

- Avoid confronting aggressive drivers—be polite and courteous, even if others are not.

- Use your turn signals and leave plenty of room when turning or changing lanes.

Let’s face it: accidents happen. And when they do, you might be looking at car repairs and injuries as well as possible increases to your insurance premium. Safe driving can go a long way in keeping you and your family safe and your premium in check. Here are seven common car accidents and tips on how to help avoid them:

1. Rear-end Collisions

Rear-end collisions are a common reason for auto insurance claims. Whether you are the driver who hits a vehicle in front of you, or the driver who gets hit by a vehicle behind you, these accidents can often be avoided. Consider these tips:

- Keep your distance. Drive far enough behind the car in front of you so you can stop safely. This is especially true in inclement weather. Stay at least three seconds behind the vehicle ahead of you, and longer if you’re in a heavier vehicle. Extend the timing when weather conditions are bad.

- Drive strategically. Avoid situations that could force you to suddenly use your brakes. If a driver is following you too closely or isn’t paying attention, you might be rear-ended.

- Don’t get distracted. Never take your eyes off the road to eat, read a text message or find your phone. If the driver ahead of you stops suddenly, it only takes a second or less of not paying attention to rear-end their vehicle.

- Don’t drive when drowsy or under the influence. You’re more likely to make driving errors when you’re sleepy or impaired by drugs or alcohol.

2. Parked Car Damage

Another common cause of auto damage: having a parked vehicle hit by another car. Whether you’re leaving your car in a parking lot or on the road, take steps to help avoid parked car collisions and claims. Here are some suggestions:

- Go the distance. Don’t park in the busiest part of a parking lot. Instead, select a space away from heavy traffic. You’ll help reduce your chance of getting hit by another car.

- Maximize the space. Always park in the center of a spot. Reposition your vehicle if it’s too close to a parking line. It will help keep your car from being hit by others pulling in to or out of adjacent spots. It can also help prevent dings from swinging doors.

- Park in a garage, if you can. The idea is to put your car in a safe place when you’re not driving it.

- Park street-smart. Try not to park near busy intersections, tight turns and driveways. Other drivers may not see your vehicle and could side-swipe it when passing by.

3. Single-vehicle Accidents

Single-vehicle losses include collisions with road barriers, debris or animals, in addition to rollovers and accidents when driving off-road. It’s not hard to help prevent them.

- Drive right for the weather. Even if yours is the only vehicle on the road on a rainy, snowy or icy day, drive at speeds that allow you to maintain control. Learn how to avoid hydroplaning on flooded roads and refresh your winter driving skills before the season begins.

- Always pay attention. Just because you’re the only person on the road doesn’t mean it’s okay to text, make hands-on phone calls or eat while driving. You never know when conditions might change.

- Don’t drive too fast. Speeding has been involved in approximately one-third of all motor vehicle fatalities for more than two decades.1 Simply put, speeding is dangerous, even if there is no one else around you.

4. Windshield Damage

Chips and cracks to vehicle windshields are a common auto accident that many drivers don’t realize they can help prevent. Most windshield damage happens when rocks and stones are thrown up in the air by other vehicles. Help prevent this damage by keeping your distance from cars and trucks.

Also, don’t drive behind snow plows when they’re dropping salt or other granular substances. Some pieces are large enough to cause chips and cracks.

5. Crashes at Intersections

Intersections are another place where accidents frequently occur. Distracted drivers may miss traffic signals changing from green to yellow to red. Or they don’t notice vehicles pausing before making turns.

Practice defensive driving to help avoid accidents. Take a moment after the light turns green to make sure no one is coming through the intersection. Look out for drivers speeding to make it through a yellow light on a cross street. When you’re approaching a yellow light, be cautious rather than take chances.

6. Parked Vehicle Theft

No matter where you park your car, there’s always a chance of a break-in. Still, there are things you can do to help prevent potential unnecessary damage to your vehicle. Keep in mind that items stolen from your vehicle could be a loss that you file under your homeowners insurance coverage. Damage that occurs to your vehicle during a break-in would be filed under your auto insurance coverage.

- Never leave valuables in a parked car. Having them in view is an invitation to thieves. Take expensive things with you, store them inside your glove compartment or lock them in the trunk.

- Never park in dark locations. Instead, find spaces in well-lit areas. Plan ahead if you’re parking prior to sunset.

7. Backing Collisions

Whether you’re backing out of a parking spot or your driveway, accidents can happen.

The best thing you can do to avoid accidents when backing up is to avoid having to back up in the first place. When possible, park in a way where you won’t have to back up into traffic, such as pulling through or backing into a parking spot.

Another helpful tip: drive vehicles that have a backup camera. If your car doesn’t have one, you can have one installed.

If you drive a car that’s not equipped with a backup camera, here are some other suggestions of what you can do:

- Before getting into your vehicle, look around to assess your surroundings and traffic patterns.

- Back out using the shortest, most direct route possible.

- Reverse in a straight line, turning only when clear of parked vehicles or any other obstructions.

- Back out slowly while continuing to check traffic around you.

- Use your mirrors and brakes until you’re completely out of the spot and integrated into traffic.

- Never do anything distracting while backing out.

While there are many things you can do to help prevent collisions, theft, injuries or damage to your vehicle, it’s not always possible to avoid the unexpected. Contact your local independent agent or a Travelers representative to make sure you have appropriate coverage to meet your needs.

More than 40,000 Americans died on the roads in 2016, the most significant increase in deaths over a two-year period in more than 50 years.1 Whether someone you love has been known to text and drive, or you have found yourself distracted behind the wheel, these tips can help avoid dangerous activity on the road.

- Stow your phone. Turning off the phone and putting it in “do not disturb” mode can help remove the temptation to browse online at a red light or respond right away to a text message.

- Vow not to multi-task. Anything that occupies your mind or vision can be a distraction behind the wheel. Make time at home to eat meals or put on makeup, so you can focus on the road.

- Don’t be a distraction. Avoid calling or texting family members and friends when you know they are driving to avoid distracting them.

- Talk to your employer. Responding to texts or taking calls for work while driving can be dangerous. Encourage your employer to have a distracted driving policy that includes waiting to talk with employees until they are safely parked.

- Keep kids and pets safe. Make sure kids are in proper car seats and that pets stay secured in their zone in the back of your vehicle. It can also help reduce distractions if pets are not roaming about the car.

- Set a good example. Parents can model good behavior for their children by demonstrating attentive driving. Avoid texting, eating, grooming or calling someone while behind the wheel.

- Plan your route before you go. Programming your navigation system while you drive can take your eyes off the road. It’s better to ask a passenger to do it or to enter your destination before you leave home.

- Speak up. If you see someone texting or otherwise driving while distracted, say something and let them know that you are not comfortable with that behavior. Encourage your children to do the same when they are passengers in a friend’s car. It could save a life.

- Set rules of the road. Consider restricting the number of passengers until your teen or new driver gains experience behind the wheel.

- Avoiding reaching. Resist the urge to reach for items if they fall while driving.

Taking your eyes off the road to search for an item can make you more likely to have an accident.

Share these tips to help keep others safe. For more on ways to reduce distracted driving, check out Every Second Matters, Travelers’ conversation starter on reducing distracted driving risk.

Source:

1 National Safety Council, NSC Motor Vehicle Fatality Estimates.

www.nsc.org/NewsDocuments/2017/12-month-estimates.pdf