The monthly MJ Sorority Newsletter – This issue covers National Preparedness Month (tips for preparing for weather emergencies), things to consider when planning a risky activity, cyber incidents, tips to minimize fraud, and food service trends for Gen Z.

The monthly MJ Sorority Newsletter – This issue covers background checks, event planning resources, rising food costs, summer to do lists & more.

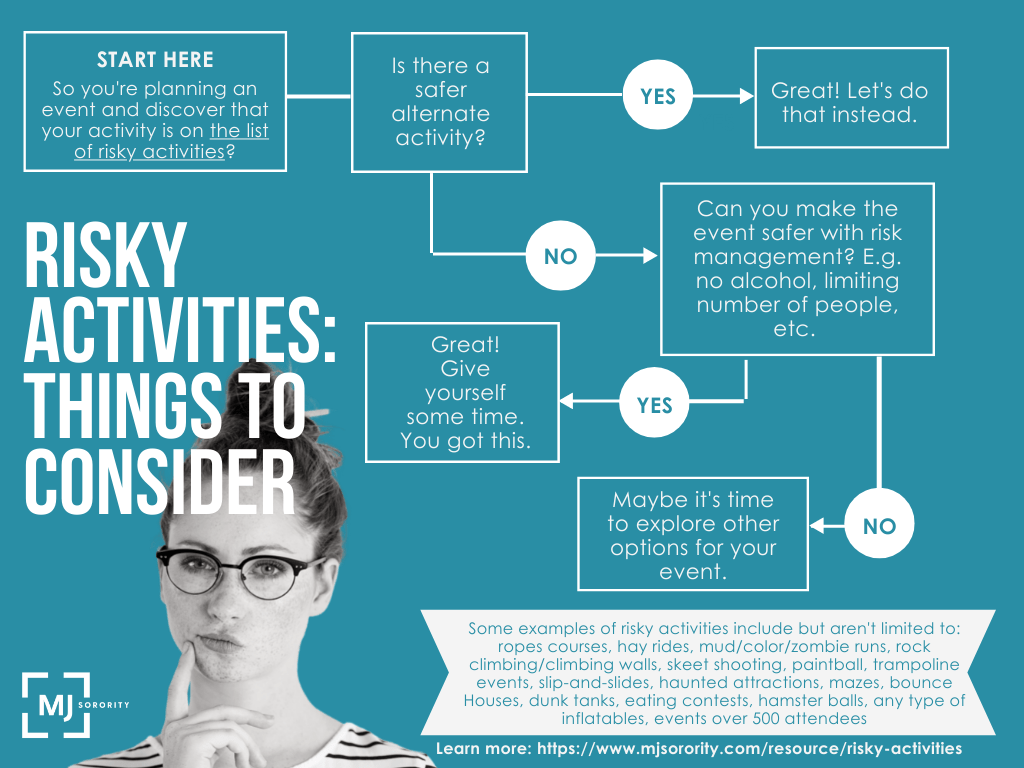

A visual aid to help you determine how to plan safer events. Print-friendly version here.

A quick, self-guided presentation to help you plan your next chapter event.

All About Waivers: Attorney and Client Executive, Estacia Brandenburg, joins us to discuss all that you need to know about liability waivers and sorority events. Sara and Estacia discuss the basics of liability waivers, our position on waivers, and several of your most frequently asked questions.

Event Planning: Special Event Policies – This episode contains a discussion with Ruth and Allison about special event policies as part of our ongoing series on event planning. They dive into what they are, when you need them, what to look for, and more.

Event Planning: All About Contracts – Ruth and Allison are back to discuss the ins and outs about insurance contracts: what are contracts, why are they important, what to look for when dealing with contracts, and why all of this matters to our clients.

Event Planning: All About Certificates – Adding to our ongoing series on event planning, Ruth and Allison discuss everything you’ve ever wanted to know about Certificates of Insurance. This is a must-listen for anyone that plans or oversees events for your chapter.

Risky Activities – In this episode we discuss what risky activities are, why chapters should be concerned about risky activities, and some easy alternative activities.

Event Planning: Part One – Ruth Akers is our resident “event planning expert.” In the first of what is sure to be many parts, we discuss some event planning basics.

We’re Back! – Our first episode back after a long COVID-19 hiatus. We share what we’ve been up to, a few lessons from COVID-19, and what we’re planning for future episodes.

Chapter Events in Light of COVID-19 – In this episode, we asked Will Frankenberger, Chief Safety Officer at Delta Zeta Sorority, to join us to discuss events in the time of COVID-19.

Chapter Housing Lessons from COVID-19 – In this episode we discuss what lessons the MJ Sorority team learned from COVID-19 as it relates to sorority chapter housing.