One of the least understood federal regulations are those included in provisions of the American with Disabilities Act (ADA). This legislation was passed in 1990 to extend the civil rights protection prohibiting discrimination to persons with disabilities.

ADA addresses the three major areas of employment, government services and public accommodations. Title III of the Act specifically

addresses the requirements of a building that is subject to this legislation.

As with most federal regulations, they often times are not accurately used and such is the case with local governments and sometimes universities will use this federal regulation terminology to serve as a big stick in their community to lead others to believe that they must comply with the ADA. They state that certain new codes are ADA required when in fact it is not part of the legislation which deals with those entities that are eligible under the Act.

Before we can even comment on whether this can be an accurate statement, it begs the question of whether women’s fraternity/sorority (sororities) properties are even subject to this legislation. The answer to that question is a resounding no, as sororities are not subject to this Act for a variety of reasons, primarily the fact that sororities are considered “private clubs” and, as such, are not subject to this legislation. Should you desire to read more detail on why a sorority is not subject to ADA, refer to this Fraternal Law article.

Should you have any questions, please don’t hesitate to reach out to your Client Executive.

WHY IS HAIL SUCH A PROBLEM FOR YOUR PROPERTY’S ROOFING?

Hail can cause serious damage to your chapter house’s roof. Hail stones are made up of ice and come in a variety of shapes, sizes, and weights, which can all contribute to the destruction of your roof after a hailstorm. The weight of hail stones is also a factor that should be taken into account when considering hail resistant roofing as an option. Hail stones can cause dents, cracks, and even holes in your roof, which will leave it vulnerable to water damage and increased energy costs.

COSMETIC/AESTHETIC DAMAGE VERSUS PHYSICAL DAMAGE TO THE ACTUAL ROOF

The insurance industry has previously been willing to repair and/or replace roofs damaged by hail that are more cosmetic in nature or to match the entire roof’s shingles with the new replaced shingles due to actual hail damage. It is fair in saying that these days may be over.

There continues to be significant shifts in the weather patterns in certain parts of the US with increased wind and hail claims. The industry is seeing an increase in the storms producing conditions of hail and wind. There is an increase in the severity of the storms, thus bringing worse damage and the expanse of the areas affected are expanding more easterly than the past.

With the significant increase in hail and wind losses, all insurance companies are being forced to more closely analyze or underwrite each property risk and are looking at numerous alternatives to encourage more roof risk management. Examples we have seen across the insurance industry include:

• Significant increases in wind and hail deductibles in the wind/hail prone areas

• Limitations and exclusions to roof damage repair and replacement

IMPACT-RESISTANCE SHINGLES

Hail resistant roofing provides property owners an extra layer of protection against the destructive nature of hail stones, which can cause significant damage to traditional shingles and other roofing materials. It can withstand impacts from hail stones at speeds up to 150 mph, which is far stronger than traditional roofing materials. This extra protection minimizes the need to replace your roof after a hailstorm hits, and an additional advantage of impact-resistance roofing is its energy efficiencies, meaning you could save money on energy bills in the long run.

Unlike traditional roofing materials, impact-resistance shingles are designed to last longer, usually up to fifty years. The costs associated with hail resistant roofing materials will vary based on the resistance rating of the materials. These ratings run from Class 1 (least resistance) to Class 4 (highest resistance). Click here to see the Insurance Institute for Business and Home Safety’s list of shingle performance ratings. Generally, these roofing materials will cost more than the traditional roofing materials, but they also come with the added protection from hailstorms, last longer than traditional roofing shingles, and provide energy efficiencies.

DON’T WAIT FOR A WIND/HAIL CLAIM TO ADDRESS THE CONDITION OF YOUR ROOF

For the property owners in the following states, there has been significant increases in storms attributing to wind and hail claims:

- Arkansas

- Kansas

- Missouri

- Nebraska

- Oklahoma

- Texas

We urge our clients in these states to take additional measures to have a sound risk management plan in place, to upgrade your roofing materials to the impact-resistance shingles when your roof needs to be upgraded, and should you have a claim, consider upgrading to the preferred materials.

ADDITIONAL ROOFING RISK MANAGEMENT

Travelers Insurance Company, who writes your property insurance, has developed an additional resource for you in your roof property management:

The ruling body for fire safety codes is the National Fire Protection Association (NFPA). This entity determines the fire safety codes and is the recognized standard by which all businesses are to follow.

It is the NFPA that sets the codes for the types of sprinkler systems that must be or can be installed in a building primarily based on its occupancy. In 1896, they developed the first code for systems in residential or habitational type occupancies: NFPA 13.

NFPA 13 is designed to serve two distinct purposes:

- To eliminate the risk of bodily injury or death of residents/guests

- To significantly reduce fire damage to the property and any subsequent water damage from the fire response efforts

The building must be 100% sprinklered including attic space whether accessible or not. The costs to install can be substantial for the following reasons:

- Piping must be steel which is more labor intensive to fabricate.

- Attics must be also be sprinklered.

- Aesthetic work is more substantial with the exposed steel pipes.

For a variety of reasons such as cost and labor, NFPA came out with a modified code in the 1970s for residential housing: NFPA 13R (Residential). The main purpose of this risk management tool was purely the protection of lives, unlike NFPA 13 which also was protecting the physical property.

A criterion for the residential housing was that the structure had to be less than four stories in height. As such, the sorority chapter houses did qualify for 13R status, with the only caveat being the attics were not to be used for any purposes and were to have limited access to the attic space.

When the interest for sprinkler systems began to escalate, we were successful in getting the insurance company to provide substantial credits for a property that met the NFPA 13R code. Even though the primary benefit was life safety or the liability exposure, the insurance company agreed to apply this credit to the property premium due to our rationale, which included the following:

- As generally 57% of the account premium is for the property exposure whereas the liability was only 15% thus the dollar discount was far more substantial

- As an inducement to get the property owners to budget for a sprinkler system

- To support the best risk management tool for life safety of your members, employees and guests

Over the years, we have seen an exposure emerge which has become a challenge, which is that the chapter house attics frequently aren’t sprinklered. Of the six property fires over $100,000 in claim cost, four of them started in the attic, which was unsprinklered and had no other type of fire detection system.

The biggest problem comes from the fact that the fire burns for some time in the attic and/or roof area, and it isn’t until it burns through the attic flooring for the debris to land on the next floor before the sprinkler system is engaged and the fire department is alerted. The second problem then comes when the fire department gets there and has to release far more water than normal to extinguish the fire. Subsequently, you have more of your building damaged by the fire and more water damage in trying to put it out.

The liability insurance company underwriters are still very pleased that there is reduced if not completely eliminated bodily injury exposure, but the property underwriters are growing concerned about the exposure of attic fires.

The obvious solution to this dilemma is to install sprinklers in the attic, but this would be virtually impossible for expense reasons. We have done extensive research on this matter and can reach no other conclusion.

We can however recommend another solution to the fire protection alert delay that presently exists which is the installing of a heat sensor to your existing fire alarm system in the attic space. The fire department gets alerted to a fire much faster than without sensors, and there is ultimately less property damage along with the life safety benefit. For further reading on heat sensors, check out these additional resources.

| You may or may not have had the opportunity to consider building new or renovating your sorority chapter house. It would be an understatement to say that there has been chaos in the construction market. Cost of materials has skyrocketed, and materials continue to be difficult to come by. A representation from a large national construction firm recently remarked, “rebuilding the same property compared to a year ago would cost at least seventeen percent more. Such increases have been fueled by an overwhelming demand for building materials and the supply chain bottleneck.” Why is this important for your chapter house? As an insured, you are obligated under your insurance coverage to insure your building and contents at the valuation of replacement cost, which does not reflect any depreciation of values due to age. The insurance company is then obligated to “repair or replace for like kind and quality” should your property be damaged due to a covered cause of loss. We are seeing new construction come in at a minimum of $200 per square foot (except in California where it is more like a minimum of $350 per square foot). In looking at near and medium term factors that will continue to affect your property valuation, the effects of inflation combined with more costly natural catastrophes, which are occurring far more frequently. The issue of valuation is further complicated in catastrophe-prone areas by the fact that potentially thousands of insured businesses will be seeking construction and professional services, such as roofers and other trades, to begin repairs on their properties at the same time. As a result, the costs of labor and materials will increase substantially (often ten to fifteen percent increases), which will then impact the cost of the claim. Another influence we have been noticing in the Sorority Department is a substantial increase in the cost of a claim. Our records indicate a jump over the last six years of 223 percent on average. We want to continue to make you aware of the trends in the marketplace. If you want to discuss your current insurance limits, we encourage you to reach out to your Client Executive to ensure you are adequately insured in light of the rapidly changing market conditions. Originally published in the April 2022 News & Notes. |

Every state has laws regarding the care and maintenance of certain mechanical pieces of equipment that potentially pose a greater risk to residents/occupants/guests in a sorority chapter house. This exposure is often referred to as boiler and pressurized vessels. We generally think of the steam operated boilers that heat a house; however, even hot water heaters in some states are also included.

Generally speaking, these laws require: (1) an operating permit to be obtained from the State Department or jurisdiction prior to operating a regulated boiler or pressure vessel; (2) all operating permit inspections to be performed by a boiler or pressure vessel inspector licensed by the Department; and (3) the Department to perform operating permit inspections on all regulated boiler or pressure vessels owned by the state.

Your insurance coverage for boilers and pressurized vessels is part of your property insurance coverage. In addition to paying for a claim should one of these items explode, the coverage also provides extensive safety engineering and inspection services which will ultimately minimize the potential for a loss.

As the law prescribes, inspections must be performed on a regular basis as determined by the state law. These could be anywhere from a quarterly to an annual inspection. As part of your insurance premium, these inspections are done by your property insurer Travelers Insurance Company, and they are free of charge.

The jurisdiction however should they be asked to inspect by the building owner would have a fee attached to that service, thus why we encourage our clients to rely exclusively upon your insurance company to fulfill this role.

There are basically two separate transactions with this exposure:

- Safety inspection-offered free of charge by the insurance company

- Issuance of the certification that is placed on the item that has a small fee assessed for the certificate by the jurisdiction, which the property owner will be responsible for paying as this is not included in the insurance coverage

The process is as follows:

- 30-45 days prior to the expiration date of the boiler or other item, Travelers secures from MJ the contact information for the house corporation and the property is inspected by a Travelers Risk Control representative. This contact person will also be receiving the invoice from the state for the issuance of the certificate. They will also be the individual receiving the certificate back from the state.

- During the inspection, they will be commenting on anything related to equipment-electrical exposures, panel concerns, etc.

- The report of the inspection is sent to the house corporation with any violations or items noted that will need to be addressed by the property owner.

- Upon addressing the violations or items, Travelers then sends the status to the jurisdiction.

- The jurisdiction will send an invoice to the property owner and once the invoice is paid, the certification will be provided.

- The certificate then needs to be prominently posted to provide to a fire marshal or someone from the jurisdiction requesting proof of the inspection.

- Should there be a mix up with Travelers missing the inspection and the state must do the inspection and then charge you, let us know as we will work with Travelers to pay that costs.

Should you have any questions or concerns, please do not hesitate to contact us.

March 2022: Topics include property claims trends, spring weather resources, FAQ on hiring contractors, 2022 MJ Housing Forum recordings and more!

January 2022: Topics include winter weather reminders, Covid-19 updates, accounting best practices, renting your chapter house for events, and insurance limits.

The milder days of spring are a perfect time to do a thorough spring cleaning and perform routine maintenance. After a long winter, it is a good idea to spend time on preventive measures to help maintain your property throughout the year. Tasks such as cleaning out your gutters, checking for dead trees and branches and cleaning and inspecting facility mechanical and plumbing systems, such as heating and air conditioning equipment, can help make spring a season of safety.

Cleaning and maintenance of your chapter house should be done inside and out. Although the tasks are different, checking to see if all the elements of your property are in good working order can help keep your members and employees safe and your maintenance expenses lower over the long run.

Inside the Chapter House

Here are a few things inside your facility that should be inspected to determine if they are in good condition:

- Electrical Outlets and Cords: Check electrical outlets and cords throughout your property for any potential fire hazards such as frayed wires or loose-fitting plugs. Extension cords and power strips are not designed to be permanent fixtures and should only be used on an interim basis.

- Fire Extinguishers: Check your fire extinguishers at least once yearly, including the hose, nozzle and other parts to determine if they are in good condition and that the pressure gauge is in the “green” range. Check the expiration date.

- Air Conditioning: Check around the unit for indications of leaks. Before turning it on for the season, have your air-conditioning system inspected and tuned up by a professional. Check the drain lines annually and clean them if they are clogged. Change the air filter.

- Water Heater: Check for leaks and corrosion. Check your owner’s manual for any recommended maintenance.

- Furnace or Boiler: Have your furnace or boiler cleaned or inspected annually.

- Under Sinks and Around Toilets: Look for any signs of leaks or corrosion on pipes, supply lines and fixtures.

- Plumbing: Check exposed pipes and valves in your basement or crawl spaces, if safely accessible, for signs of leaking or corrosion.

- Appliances: Check supply lines for washing machines, ice makers and water dispensers, refrigerators, and dishwashers for signs of leaks or wear and tear.

- Plumbing for Hose Spigots and Irrigation Systems: After opening valves for outdoor water supplies, be sure to inspect components for leaks. Don’t forget to check inside plumbing as well as outdoor spigots.

- Dryers: Dryer lint can build up inside the vent pipe and collect around the duct. Clean both the clothes dryer exhaust duct and the space under the dryer. Use a brush to clean out the vent pipe. Look for lint buildup around the lint trap and clean it as needed.

- Smoke Detectors: Daylight savings time is a good time to change the batteries in your smoke detectors. Inspect each smoke detector to determine if all are in working order, and make sure to test them monthly.

- Light bulbs: Check each light bulb in every fixture for the correct recommended wattage and replace any burned out bulbs.

Outside the Chapter House

The cold winter months can do damage to your property as well. Here are a few things outside your facility that should be inspected to ensure they are in good condition:

- Roof: Check for any damage from snow or ice, and make any necessary repairs to reduce the possibility of leaks. If you have a skylight, check outside for a buildup of leaves and debris. Also, check the indoor ceiling for signs of leaks. Remember to put safety first any time you are on a roof. If you have any doubt, leave it to the professionals.

- Gutters: Clean leaves and other debris from gutters and downspouts to keep water flowing and reduce the possibility of water damage.

- Trees: Visually inspect trees for damage or rot, and remove (consider hiring a licensed professional) any dead trees that might blow over in heavy winds or during a storm. Keep healthy trees and bushes trimmed and away from utility wires.

- Lawn Equipment: Make sure lawn mowers, tractors and other equipment are tuned up before using. Store oil and gas for lawn equipment and tools in a vented, locked area.

- Walkways and Driveways: Repair any cracks and broken or uneven surfaces to provide a safer, level walking area.

A little home maintenance in the spring can go a long way to help keep the chapter house safe and secure throughout the rest of the year.

Unofficial Houses: What, Why, & How – In this episode, Allison and Sara discuss what we call “unofficial houses.”

October 2021: Topics include Leak Protection, water damage, COVID-19, & wellness rules overview.

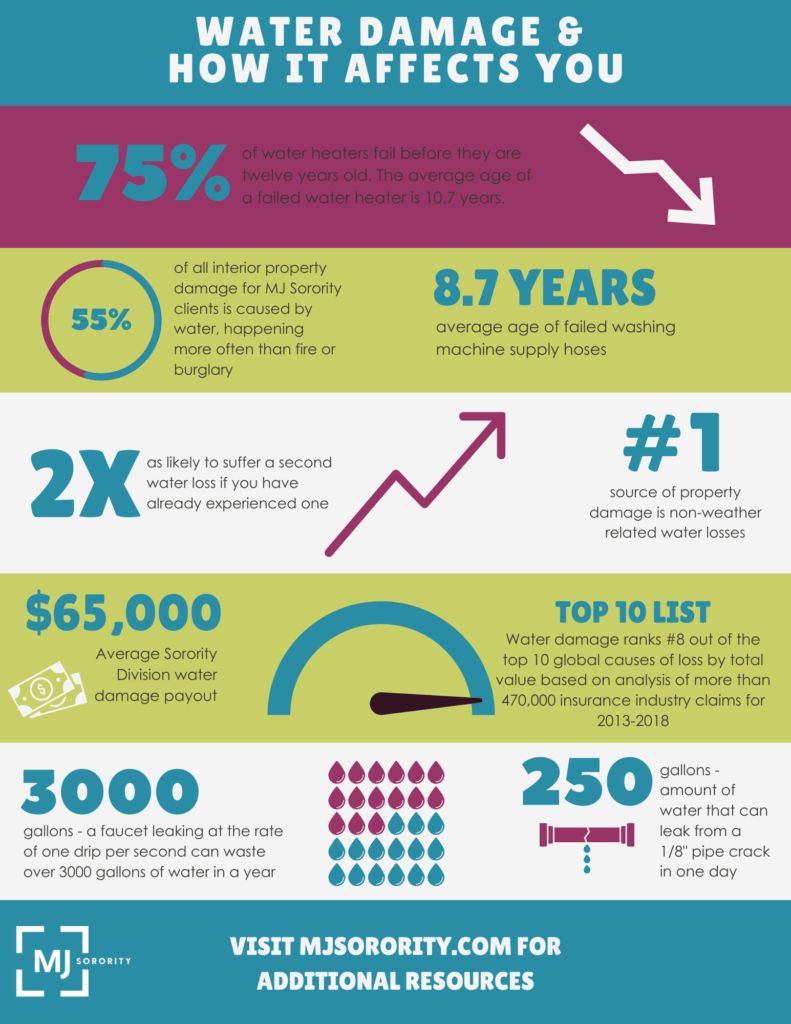

In the MJ Sorority Program, 55% of property claims are due to water-related issues. The most common reasons for water damage are: water pipes bursting, frozen pipes thawing, and sewage and drain backups; but burst pipes, roof leaks, overflowing toilets and leaking appliances can also cause significant damage. These types of water damage can also result in business interruption, relocation costs, lost rents and can negatively impact your reputation as a business.

Though you do have broad water damage insurance protection, as the property owner, you should consider all types of tools to help you prevent water damage events and/or reduce the impact of a water claim. Installing leak detection and flow monitors also make your property eligible for a 5% credit at renewal, applied to your property insurance premium.

One of the best things that you can do to reduce and prevent water damage is to install a flow-based water leak detection device. The most comprehensive tool available is a leak protection system, which includes both a flow-based monitoring system and detectors or water sensors.

Below we explain the components of a comprehensive leak protection system. You can find specific technology and partner recommendations in this article.

How does a flow-based water shut-off device work?

Installed by a plumber directly onto your water line, a flow-based water leak detection device monitors the flow of water throughout your chapter house. If an unusual activity or flow of water is detected – probably caused by a leak somewhere in your plumbing or pipes – the device will alert you first, and then shut off your water supply to help minimize damage.

How do water sensors work?

The water sensors, placed throughout your property, can detect the presence of water, often by measuring the electrical conductivity of the water present and completing a circuit to send a signal to either an email or text.

Where should water sensors be placed?

Water sensors should be placed strategically throughout the chapter house to maximize detection. Performing regular maintenance and checking for rusty, corroded, or damaged water supply lines before you have a leak is one of the best ways to help prevent water damage.

You might want to install water sensors in areas near:

- Washing machines

- Dishwashers

- Refrigerators with ice makers and water dispensers

- Hot water heaters

- Sinks

- Toilets

- Around exposed pipes

- Furnaces connected to water systems, including hot air system humidifiers

If you are having a professional plumber install your sensors, they will be able to provide advice on how many to install and where to install.

Additional Tips to Consider

Choose a flow-based leak detection device. While individual sensors that detect the pressure of water are acceptable, they cannot test for microleaks, monitor water usage, or detect burst pipes in walls or under foundations. The flow-based devices provide enhanced protection, functionality, durability, reliability, accuracy, and great value for the cost.

Several MJ Sorority clients have installed flow-based devices and the cost for a typical sorority chapter house range from $2,500-$4,000 per location. As mentioned before, when leak detection and flow monitors are installed, your property will be eligible for a 5% discount to your property insurance premium at renewal.

Select a device that automatically shuts off the water when a pipe ruptures or another water anomaly occurs. These preferred flow-based devices not only detect trouble, but also help mitigate the problem itself.

Hire a plumber to professionally install your flow-based leak detection device. Your devices should be installed on your domestic water main pipe near where it enters your chapter house. These devices will need access to a power outlet and a wi-fi router signal.

Determine your water main pipe size to order the right produce size. Ask your licensed plumber, contractor or product vendor to assist you in picking out the best device for your chapter house.

As we mentioned in above, roughly 55% of MJ Sorority property claims are water damage-related. Any preventative action will certainly reduce, not only the amount of damage, but the disruption to chapter operations. Even when the claim is handled expediently and thoroughly, it often requires your member residents to have to relocate to other lodging, which impacts their member experience and causes additional headaches for the House Corporation volunteers and/or property managers.

For a more in-depth explanation of the leak detection technologies available and specific companies that we recommend, please refer to this resource.

For further reading on preventing water damage, refer to our printable infographic or this resource for additional tips. For further information on water damage claims for the MJ Sorority book of business, refer to this infographic.