The Perfect Storm: Navigating the Crisis in Property Insurance

Background

Over the past five years, property insurance companies have faced significant challenges in maintaining profitability. A surge in catastrophic claims, changing weather patterns, and rising temperatures have contributed to this crisis. Factors such as the increasing severity of claims, dramatic rise in material costs, and historical underinsurance have compounded the problem. Additionally, there has been a startling rise in the number of billion-dollar disasters. These issues have forced insurance companies to implement rate increases, reduce coverage limits, and modify terms and conditions. The situation reached a breaking point with the devastating Hurricane Ian and subsequent winter storm of 2023. We are now in the midst of the worst property insurance market the industry has ever seen.

The Changing Landscape

The current state of the property insurance market demands a shift in the way insurance is approached. Insurers are being forced to move away from acting as quasi-warranty replacement policies and focus more on covering larger or catastrophic claims. Property owners must prepare for higher property deductibles and invest in building modifications and maintenance measures that reduce potential weather damage and the extent of damage. The industry is refining its underwriting strategies for risks such as tornadoes, wind, hurricanes, floods, wildfires, hailstorms, and freezes. Predictive modeling is getting more sophisticated and accurate, enabling insurers to better assess risk based on big data, the increasing speed of climate change, and subsequent specific locations prone to particular risks.

The crisis is not isolated to a single insurance company but is affecting the entire industry. The reinsurance market, heavily impacted by Hurricane Ian, is facing a day of reckoning. Rate increases and adjustments to coverage limits, deductibles, exclusions, and limitations have become prevalent. This situation poses challenges for insurance providers and agents, as many markets have declined coverage due to a concentration of residential frame housing values, as we already seeing in Florida and California.

Facing the Current Situation

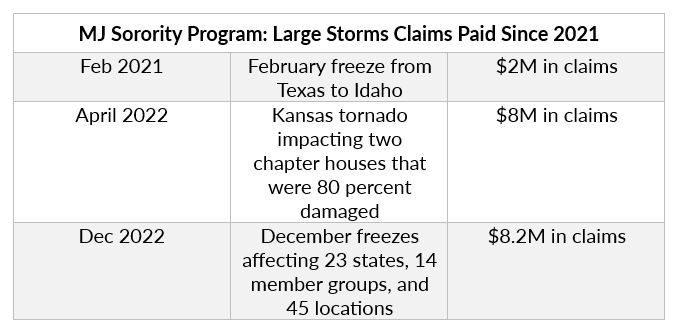

MJ Sorority has shielded clients from market volatility in the past (see graphic) but now is being forced to address the evolving landscape. The insurance provider for the MJ Sorority Program, Travelers Insurance Company, informed us that they would be addressing conditions, rates, and deductibles upon each client’s renewal. Travelers’ actions are indicative of industry-wide changes that require careful consideration. Rest assured that unlike what we’re seeing in the homeowners’ markets[1], capacity and coverage are not at risk.

Conclusion

The property insurance market is facing unprecedented challenges due to an array of factors. Insurers and insureds alike must adapt to the evolving landscape by embracing a new business model that emphasizes coverage for larger or catastrophic claims. Increased property deductibles, building modifications, and refined underwriting practices are crucial steps. The industry’s focus on predictive modeling and big data can help allocate risk more effectively. MJ Sorority understands the difficulties posed by the crisis, and we are dedicated to enhancing risk management advice and resources, particularly regarding wind and hail perils, both at the headquarters level and among local housing volunteers.

By working together, insurers and insureds can navigate the perfect storm and ensure continued protection against unforeseen property losses. Please do not hesitate to reach out to your Client Executive with questions and concerns.

[1] For further reading about the insurance market, refer to the links embedded in the document above or review the following links fur further reading:

- Allstate Stops Selling New Home-Insurance Policies in California, Citing Wildfire Risks, Wall Street Journal, June 5, 2023.

- Insurers Fleeing California Market Want Rate-Hike Flexibility, Bloomberg Law News, June 14, 2023.

- America’s growing hurricane wind problem, Axios, February 27, 2023.

- Florida’s hurricane danger: It’s not the wind, it’s the water, Tampa Bay Times, June 6, 2023.

- Why Is Homeowners Insurance In Florida Such A Disaster?, Forbes, April 11, 2023.

- Property Insurance Market ‘Hardest in a Generation’, Claims Journal, March 28, 2023.

- Several factors pushing property insurance prices higher, Business Insurance, June 9, 2023.