We have seen a recent uptick in phishing scams among MJ Sorority clients. In today’s digital age, the threat of phishing is more prevalent than ever before. Did you know that over 90% of successful hacks and data breaches start with phishing scams? It’s a sobering statistic that underscores the importance of staying vigilant against this pervasive threat.

But what exactly is phishing? Simply put, it’s the process of attempting to acquire sensitive information, such as usernames, passwords, and credit card or bank account details, by masquerading as a trustworthy entity. Phishers often use bulk emails that try to evade spam filters, claiming to be from popular social websites, banks, auction sites, or IT administrators. It’s a form of criminally fraudulent social engineering that preys on unsuspecting individuals.

Understanding the Techniques

Phishing techniques have evolved over the years, becoming increasingly sophisticated and diverse. From traditional email and spam campaigns to more targeted approaches like spear phishing and session hijacking, cybercriminals employ a wide array of tactics to deceive their victims. They manipulate links, inject malicious content, and even resort to voice calls and SMS messages in their quest to obtain personal information.

Stay Vigilant

So, how can you protect yourself against phishing attacks? Awareness is key. Familiarize yourself with the common techniques used by cybercriminals, and adopt anti-phishing strategies to safeguard your information. Be cautious when clicking on links or downloading attachments from unknown sources, and always verify the authenticity of requests for personal or financial information.

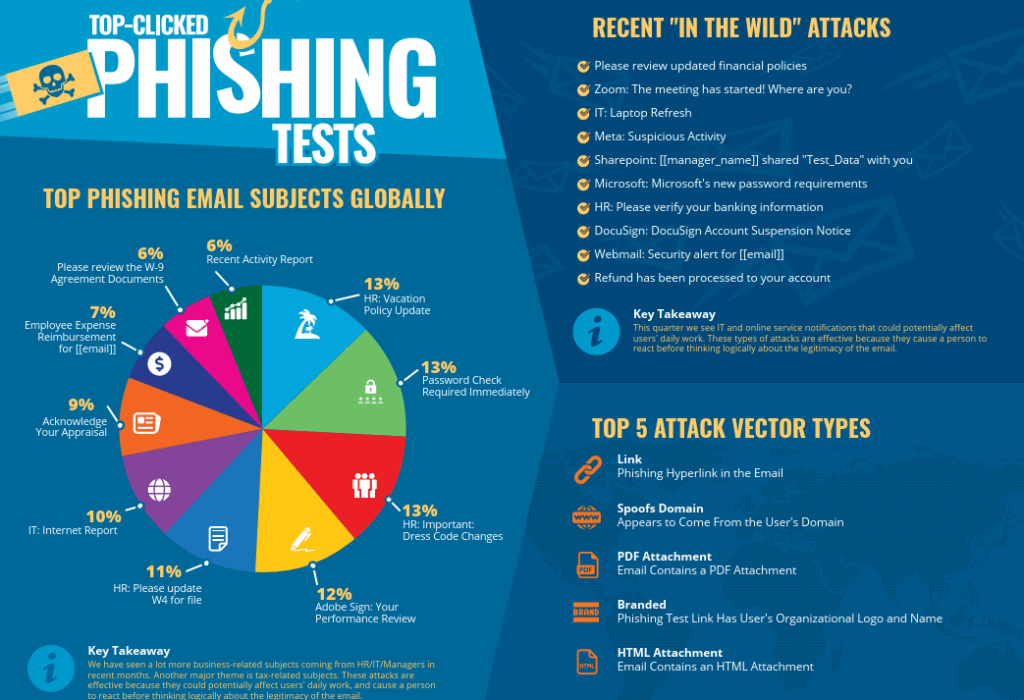

At MJ, we utilize KnowBe4, a firm that provides security awareness training to members of your organization. Each quarter, they produce an infographic with the top types of phishing attacks, as excerpted above. For the full infographic and associated data, click here. KnowBe4 also offers a free phishing security test that you can utilize to see if your employees are susceptible to phishing attacks – learn more here.

Help us welcome our new Director of Risk Management Education and learn more about Kit Moorman. Learn more and read our press release.

In order to maintain a positive and supportive environment within sororities, as well as manage the risk of escalation during disagreements, it is essential to establish effective mechanisms for dispute resolution among sorority members.

As the cost and administrative burden of litigation continues to grow, MJ Sorority supports the inclusion of binding arbitration clauses in membership agreements as a fair and efficient form of dispute resolution. Binding arbitration clauses are standard practice in many industries today, and if executed thoughtfully, can benefit both the organization and its members.

What is arbitration?

Arbitration is a formal method of dispute resolution that provides an alternative to traditional litigation. Overseen by a neutral arbitrator or arbitrators, parties to a dispute present evidence, make arguments, and are bound by the arbitrator’s decision, much like the formal litigation process. However, there are some important distinctions between arbitration and litigation. Arbitration is a private process and typically much more efficient. Additionally, parties to an arbitration choose the arbitrator presiding together, or in the case of a tribunal, each choose an arbitrator, who then in conjunction with one another, choose the third arbitrator on the panel.

How do arbitration clauses become relevant during a dispute?

Typically, arbitration clauses are leaned upon when one of the parties to a dispute changes its mind about using the arbitration process and wants to “have their day in court.” The court then looks to the original agreement to determine the validity of the arbitration clause and if the language of the arbitration agreement passes muster, the court will hold the parties to their agreement and send the dispute to a neutral, third-party arbitrator.

This is why arbitration clauses should be presented as part of an organization’s membership agreement, ensuring that there is a clear written record from the moment a member joins the organization.

What are the key components of an arbitration clause?

To ensure that arbitration clauses included in membership agreements are enforceable, a few key components should be present:

- Specific language—The agreement should clearly outline what types of disputes will go to arbitration. The agreement must clearly state that signing the agreement means that both parties waive their right to recourse in court.

- Meaningful choice—Courts want to ensure that all parties to an agreement have equal bargaining power. New members should be given meaningful opportunity to study and ask questions about their membership agreement, including the arbitration clause.

- Notice/Acceptance—When implementing a dispute resolution program using arbitration, the contracting sorority needs to have a written record of putting their existing members on notice of the program, if applicable. Where possible, a sorority should collect assent to an arbitration program from existing members via signature. Inclusion of an arbitration clause in the membership agreement for new members satisfies these concerns.

- Confidentiality—While arbitration takes place behind closed-doors, meaning that the proceedings are not open to the public, there must be an additional clear agreement to maintain confidentiality. It’s recommended that membership related offenses be handled internally to maintain the privacy of members and foster trust and openness in the dispute resolution process. Including confidentiality language in the arbitration agreement will bind parties to the to keep the process confidential.

Keeping these components in mind while drafting arbitration clauses will bolster their validity and ensure all parties have clear expectations of the arbitration process.

What are the challenges of binding arbitration? What concerns does MJ Sorority have with arbitration clauses?

When arbitration clauses first came into fashion in the early ‘00s, courts were mostly deferential to such clauses and did not entertain challenges to their validity. In the last 15 years, courts have become much more wary of arbitration clauses, in some cases, finding them unconscionable, meaning that they are held invalid.

Claims of unconscionability, while hard to win, are important to consider when drafting and distributing membership agreements with arbitration clauses.

What is the benefit of arbitration over mediation or traditional litigation?

The arbitration process is private, helping parties avoid potentially lengthy, public, and expensive litigation. Furthermore, unlike in mediation, the arbitration process authorizes a neutral arbitrator to make a decision about the dispute, including the arbitration award, which is then only confirmed by a court. Typically, the arbitration agreement will include language that waives the parties’ right to appeal on substantive grounds in a court of law, limiting costs for all involved.

What is MJ Sorority’s Opinion on arbitration for dispute resolution?

While organizations should examine arbitration laws in each state of chapter operation, binding arbitration clauses are generally recommended to be part of membership agreements. If used, these clauses should be carefully worded to be specific and reasonable to both the contracting member and the organization. Organizations must demonstrate that there is equal bargaining power between the contracting parties and that the language used is specific and unambiguous. Organizations should also put existing members that have not signed an updated membership agreement on notice of an arbitration program’s implementation and collect assent via signature where possible.

Further Information:

The monthly MJ Sorority Newsletter – This issue covers background checks, event planning resources, rising food costs, summer to do lists & more.

For more information on preventing phishing scams, review this resource from Chubb, the cyber security carrier for MJ Sorority clients.

MJ Sorority’s monthly newsletter. This issue covers boiler inspections, increasing construction costs, spring chapter house inspection recommendations, and more.

March 2022: Topics include property claims trends, spring weather resources, FAQ on hiring contractors, 2022 MJ Housing Forum recordings and more!

January 2022: Topics include winter weather reminders, Covid-19 updates, accounting best practices, renting your chapter house for events, and insurance limits.

Event Planning: Special Event Policies – This episode contains a discussion with Ruth and Allison about special event policies as part of our ongoing series on event planning. They dive into what they are, when you need them, what to look for, and more.

Unofficial Houses: What, Why, & How – In this episode, Allison and Sara discuss what we call “unofficial houses.”

October 2021: Topics include Leak Protection, water damage, COVID-19, & wellness rules overview.