From May 2024 News & Notes

In times like these, the stability of your insurance companies is critical. The pandemic challenged every aspect of the fraternal community. Both your insurance companies and MJ Sorority, as your insurance agent, made significant concessions to help alleviate some of the pressures your organizations have faced.

The insurance industry went from the chaos of the pandemic to the chaos of the effects of climate change, specifically the catastrophic weather events we’ve experienced over the last several years. Insurance coverage and policy terms and conditions are on a collision course with the changing climate in many states, most notably in Florida and Louisiana. The seriousness of changing climate patterns is further compounded by the fact that in Florida’s southwestern coastline, sea levels have risen eight inches since 1950, and the risk of storm surge is estimated to double by 2030. Louisiana’s coastline is facing a similar risk. Florida is by far the most worrisome for standard property insurance companies. Several insurance companies providing property insurance in the state have gone insolvent despite state and industry efforts to prevent insolvency. To stabilize the insurance market, the Florida state government began the Florida Hurricane Catastrophe Fund in 1992. The Fund reimburses insurers for a percentage of catastrophic hurricane claims. Insurers of last resort were formed and in 2002, both carriers merged to become Citizens Property Insurance Corporation. Some additional insurance capital (or capacity) is returning to Florida in 2024, however, this has not provided much, if any, relief to consumers trying to find insured coverage for their property.

As we’ve discussed repeatedly in this newsletter, the property insurance market has been chaotic for several years. Recently, the MJ Sorority program has experienced rate increases and changes in wind and hail property deductibles in certain parts of the country.

It’s natural to feel that these changes suggest your insurance companies are abandoning the program. However, these actions are actually positioning the program for a stable future.

Without the stability of the MJ Sorority program and our partnering insurance companies, your insurance coverage would be far more vulnerable. The saying, “you get what you pay for,” is especially true for the insurance program provided by MJ Sorority. Otherwise, you risk compromising your crucial protection.

Should you wish to discuss the property insurance industry concerns further, please do not hesitate to contact us.

In the News

The property insurance crisis has been making headlines outside of your typical insurance industry publications. To learn more, we recommend the following:

- Motley Fool: How property insurance will be impacted specifically in all 50 states

- New York Times: Insurers Around the U.S. Bleed Cash From Climate Shocks

- The Daily Podcast: The Possible Collapse of the US Home Insurance System

- Fox Business: Insurance costs could surge even higher as states brace for ‘hurricane season from hell’

- Marketplace: The main reason for higher home insurance costs is climate change, which is increasing the frequency and severity of extreme weather events.

Help us welcome our new Director of Risk Management Education and learn more about Kit Moorman. Learn more and read our press release.

This edition of the MJ Sorority newsletter covers the following topics: property market insurance update, building a reserve fund, addressing check fraud , 2024 economic outlook, FAQs, and more.

Background

Over the past five years, property insurance companies have faced significant challenges in maintaining profitability. A surge in catastrophic claims, changing weather patterns, and rising temperatures have contributed to this crisis. Factors such as the increasing severity of claims, dramatic rise in material costs, and historical underinsurance have compounded the problem. Additionally, there has been a startling rise in the number of billion-dollar disasters. These issues have forced insurance companies to implement rate increases, reduce coverage limits, and modify terms and conditions. The situation reached a breaking point with the devastating Hurricane Ian and subsequent winter storm of 2023. We are now in the midst of the worst property insurance market the industry has ever seen.

The Changing Landscape

The current state of the property insurance market demands a shift in the way insurance is approached. Insurers are being forced to move away from acting as quasi-warranty replacement policies and focus more on covering larger or catastrophic claims. Property owners must prepare for higher property deductibles and invest in building modifications and maintenance measures that reduce potential weather damage and the extent of damage. The industry is refining its underwriting strategies for risks such as tornadoes, wind, hurricanes, floods, wildfires, hailstorms, and freezes. Predictive modeling is getting more sophisticated and accurate, enabling insurers to better assess risk based on big data, the increasing speed of climate change, and subsequent specific locations prone to particular risks.

The crisis is not isolated to a single insurance company but is affecting the entire industry. The reinsurance market, heavily impacted by Hurricane Ian, is facing a day of reckoning. Rate increases and adjustments to coverage limits, deductibles, exclusions, and limitations have become prevalent. This situation poses challenges for insurance providers and agents, as many markets have declined coverage due to a concentration of residential frame housing values, as we already seeing in Florida and California.

Facing the Current Situation

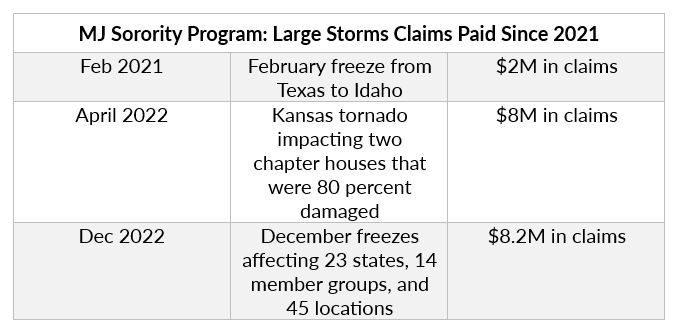

MJ Sorority has shielded clients from market volatility in the past (see graphic) but now is being forced to address the evolving landscape. The insurance provider for the MJ Sorority Program, Travelers Insurance Company, informed us that they would be addressing conditions, rates, and deductibles upon each client’s renewal. Travelers’ actions are indicative of industry-wide changes that require careful consideration. Rest assured that unlike what we’re seeing in the homeowners’ markets[1], capacity and coverage are not at risk.

Conclusion

The property insurance market is facing unprecedented challenges due to an array of factors. Insurers and insureds alike must adapt to the evolving landscape by embracing a new business model that emphasizes coverage for larger or catastrophic claims. Increased property deductibles, building modifications, and refined underwriting practices are crucial steps. The industry’s focus on predictive modeling and big data can help allocate risk more effectively. MJ Sorority understands the difficulties posed by the crisis, and we are dedicated to enhancing risk management advice and resources, particularly regarding wind and hail perils, both at the headquarters level and among local housing volunteers.

By working together, insurers and insureds can navigate the perfect storm and ensure continued protection against unforeseen property losses. Please do not hesitate to reach out to your Client Executive with questions and concerns.

[1] For further reading about the insurance market, refer to the links embedded in the document above or review the following links fur further reading:

- Allstate Stops Selling New Home-Insurance Policies in California, Citing Wildfire Risks, Wall Street Journal, June 5, 2023.

- Insurers Fleeing California Market Want Rate-Hike Flexibility, Bloomberg Law News, June 14, 2023.

- America’s growing hurricane wind problem, Axios, February 27, 2023.

- Florida’s hurricane danger: It’s not the wind, it’s the water, Tampa Bay Times, June 6, 2023.

- Why Is Homeowners Insurance In Florida Such A Disaster?, Forbes, April 11, 2023.

- Property Insurance Market ‘Hardest in a Generation’, Claims Journal, March 28, 2023.

- Several factors pushing property insurance prices higher, Business Insurance, June 9, 2023.

March 2021: Topics include COVID-19 vaccine questions, new OSHA guidelines for the workplace, medical marijuana, and discrimination legislation.