Resource Library

Our resource library is full of helpful information about sorority risk management. From emergency planning to insurance programs to tax issues, we have you covered.

FILTER

type

category

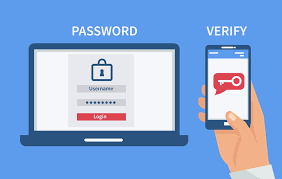

Why two-factor authentication is your best cyber defense

Learn more about two-factor authentification and why it is so important

The Prevalence of Check Fraud, and How to Protect Your Organization

Best practices to protect your chapter or house corporation from check fraud.

Preventing Check Fraud

We have seen a recent uptick in fraudulent check claims. In this article, we share some helpful tips to mitigate your risk.

News & Notes: September 2023

This edition of the MJ Sorority newsletter covers the following topics: property market insurance update, building a reserve fund, addressing check fraud , 2024 economic outlook, FAQs, and more.

Roadmap for Chapter Officers

Semi-annual email newsletter sent to chapter presidents, officers, and chapter advisors.

News & Notes: August 2023

This edition of the MJ Sorority newsletter covers the following topics: property market insurance update, back to school risk management resources, 2024 economic outlook, FAQs, and more.

News & Notes: June-July 2023

This edition of the MJ Sorority newsletter covers the following topics: property market insurance update, summer risk management resources, reviewing contract basics, and more.

News & Notes: March 2023

This edition of the monthly MJ Sorority newsletter covers the following topics: spring weather resources, important update about sprinkler credit, risky activities, Housing Forum session from Dr. Marlon Gibson, mental heath webinar, FAQ about workers’ compensation, and more.

News & Notes: February 2023

This edition of the monthly MJ Sorority newsletter covers the following topics: highlights from the 2023 MJ Housing Forum, risk management advice for hail season, cybersecurity prevention, FAQ about passenger vans, and more.

News & Notes: January 2023

This edition of the monthly MJ Sorority newsletter covers the following topics: winter storm update, winter driving tips, FAQ about volunteer’s insurance recommendations, preventing frozen pipes, preventing slips and falls.

Planning an Event for Your Chapter: A Checklist

A quick, self-guided presentation to help you plan your next chapter event.

Insurance Basics for Chapter Presidents

A self-guided presentation covering risk management basics for chapter presidents.

The Coming Mental Health Crisis

Will Frankenberger, MJ’s Health Promotion Consultant, presents a session on the coming mental health crisis, especially as it relates to chapter housing

Risk Management Bulletin: Mental Health Awareness Month

In this bulletin, we have researched several mental health resources that you may want to share with your members and volunteers.

News & Notes: June 2022

This issue covers summer reminders, the letter to member’s parents template, summer to do list, automobile liability graphic, and more.

Mental Health Resources for College Students

Rates of mental illness on campus are skyrocketing. We share some resources that we hope are helpful.

News & Notes: April 2022

MJ Sorority’s monthly newsletter. This issue covers boiler inspections, increasing construction costs, spring chapter house inspection recommendations, and more.

Real Talk Podcast: All About Waivers

This podcast discusses the basics of liability waivers, our position on waivers, and several FAQs on waivers.

Real Talk Podcast – Event Planning Series: Special Event Policies

This podcast discusses special event policies – what they are, when you need them, and more!

Real Talk Podcast – Unofficial Houses: What, why, and how

This podcast discusses the what, why, & how of unofficial chapter houses.

Real Talk Podcast – FAQs: Commercial Auto Insurance

This podcast discusses the basics of commercial automobile coverage.

Real Talk Podcast – Event Planning Series: All About Contracts

This podcast discusses insurance contracts.

Real Talk Podcast – Event Planning Series: All About Certificates

This podcast discusses everything you need to know about Certificates of Insurance.

COVID-19 Guidance for Fall 2021

Updated COVID-19 guidance for sorority chapters and house corporations as we begin the Fall 2021 academic year.

Real Talk Podcast: Digging into designated driver and sober sis programs

This podcast discusses MJ’s position on kids at the chapter house/premises.

Real Talk Podcast: Risky Activities

This podcast episode discusses risky activities and why chapters should avoid them.

Real Talk Podcast: Chapter Housing Lessons from Covid

These podcast episodes discuss COVID-19: planning events and chapter housing.

Real Talk Podcast – Event Planning Series: All About Liquor Liability

This podcast episode discusses all about liquor liability.

Real Talk Podcast – Emotional Support Animals: An Evolving Approach

This podcast episode contains an excerpt from our Housing Forum on the Road series discussing various approaches to Emotional Support Animals.

Liability Claim Example: Premises Claim / Parent Injury

A liability claim example on a premises/parent injury claim.

Liability Claim Example: Setting up for an event

A liability claim example on setting up for an event.

Liability Case Study: Unofficial Chapter House

A liability claim example on unofficial chapter houses.

Unofficial Chapter Houses

A position paper on unofficial chapter houses and the liability risk they pose.

Liability Case Study: Loaning the chapter house to a third party

A liability claim example on loaning the chapter to a third party.

Liability Case Study: Homecoming Float Claim

Scenario A member was injured while climbing onto the sorority’s homecoming float. The member was walking along side the float with other members. The float was towards the back of the parade and was starting to fall behind. The walkers were instructed to board the float to speed up the procession. While the member was boarding the float, the driver accelerated. The member was […]

Liability Case Study: Policy Infraction

Scenario A member was injured at a chapter event when she stepped on a piece of glass that was on the dance floor and sustained a laceration to her foot. There was a sign posted at the bar stating that no glass bottles were to be taken onto the dance floor. It was discovered that […]

Liability Case Study: Bus Incident

Scenario The chapter hired two buses to take their members and guests to and from an event. One bus had security, but the senior bus did not. On the senior bus, a fight broke out between two members’ boyfriends. One of the young men sustained a broken nose, as well as other facial fractures during […]

Avoiding influenza with good personal health habits

A guide on how to avoid influenza with good personal health habits.

Influenza Checklist for Chapter Houses

Influenza (Flu): reducing the risk of exposure in the chapter house.

Burn & Fire Safety

A study conducted to understand college students’ views and knowledge of burn and fire safety.

Athletic Programs: Playing it Safe

Athletic programs should incorporate risk control principles to mitigate risks.

Using personal homes for chapter events

Memo discussing the use of individual homes for chapter events.

Personal injury versus bodily injury

The difference between personal and bodily injury in insurance policies.

Steps to Receiving your Certificate of Insurance in a Timely Manner

A helpful resource to review before signing a contract.

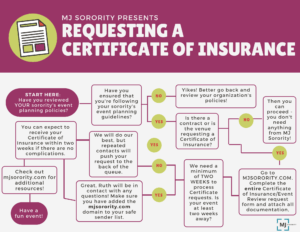

Requesting a Certificate Flowchart (printable)

A printable decision-tree to walk you through the process of requesting a Certificate of Insurance.

Planning safer events during the COVID-19 pandemic

At MJ Sorority, we created this resource packet to help our clients plan safer events during the COVID-19 pandemic.

Participant waiver template for COVID-19

Should you wish to use a waiver to attempt to release your organization from COVID-19 related claims, our in-house attorney created this template for MJ Sorority clients’ use. For more information on our position on waivers, please refer to our position paper.

Campus Crisis Planning

A resource developed for universities from Travelers, the insurance company for MJ Sorority clients, much of which is applicable to sororities as well.

Crisis planning and prevention

A guide developed by Travelers, the insurance company for MJ Sorority clients, to help you plan for the unexpected and explain why it is critical to do so.

Digging Deeper: Directors & Officers coverage

Digging deeper into how Directors and Officers Liability coverage works.

Digging Deeper: Non-owned and hired automobile liability

Digging deeper into how the non-owned and hired automobile coverage works.

Position Paper: Designated Driver/Sober Sis Programs

MJ Sorority’s position on sober sis/designated driver programs.

Position Paper: Fundraising at sporting events

We have seen an increase in the number of requests from the collegiate chapters to participate in the concession area for an athletic event at the sports stadiums.The requests generally come about because the company managing the concessions wants the group to show evidence of insurance; thus a request to us for a Certificate of […]

Position Paper: FERPA’s Impact on Women’s Fraternities and Sororities

What does the Family Educational Rights & Privacy Act (FERPA) Mean for Us?

Position Paper: Liability Waivers & Template

Our risk management position on the use of liability waivers and our waiver template for our clients’ use.

Liability Case Study: Post-event Incident

Two members attended a semi-formal event in which alcohol was served by a third-party vendor. Both members were over 21 and reportedly had been drinking at the event. It is believed that they were walking home from the party and became disoriented and lost. One member tripped and fell as she walked into the street. […]

Certificates of Insurance: What and Why?

What are Certificates of Insurance and why would someone want one from you.

Digging Deeper: Non-Owned & Hired Automobile Coverage

Non-Owned Automobile Liability is the most commonly misunderstood coverage in the Sorority Book of Business. Non-Owned Automobile Liability is designed to protect the organization for the risk of being named in a lawsuit involving an automobile. It does not protect individuals who are driving on behalf of the Sorority/Fraternity. Non-Owned and Hired automobiles are automatically […]

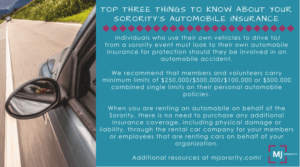

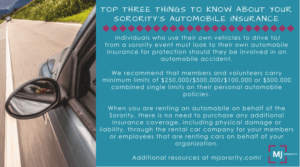

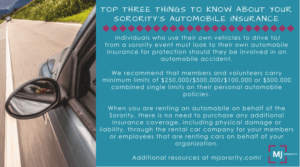

Things to Know About Your Organization’s Automobile Policy

Check out the Insurance Summary for more detailed information about your organization’s automobile policy, but the below graphic has the top three things to remember: Here is a print-friendly PDF version.

Collegiate Chapter Members and Chapter Advisors Serving on the Local House Corporation Board

MJ Sorority’s position on chapter members and advisors serving on local House Corporations.

What To Do In The Event of A Claim

When the unexpected happens, report your claim right away to put yourself in the surest position—and best enable us to help.

Certificates of Insurance: What and Why?

What is a Certificate of Insurance and why someone would need one from you.

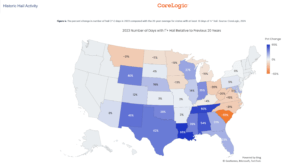

Updating and Maintaining Your Chapter House Roof

As weather patterns continue to evolve, it is crucial for housing corporations to update their chapter house roofs to withstand the increasing intensity of wind and hail events. Convective storms in particular are a major cause for concern.

Preventing Check Fraud

We have seen a recent uptick in fraudulent check claims. In this article, we share some helpful tips to mitigate your risk.

News & Notes: October 2022

This edition of the monthly MJ Sorority newsletter covers the following topics: winter weather preparedness, Greek kitchen design trends webinar, required conditions under the crime policy, cyber security awareness month, and contracts FAQ.

Employee Safety Basics

A self-guided presentation that we recommend all employees review annually to refresh themselves on safety basics.

News & Notes: April 2022

MJ Sorority’s monthly newsletter. This issue covers boiler inspections, increasing construction costs, spring chapter house inspection recommendations, and more.

Real Talk Podcast – FAQs: Commercial Auto Insurance

This podcast discusses the basics of commercial automobile coverage.

COVID-19 Guidance for Fall 2021

Updated COVID-19 guidance for sorority chapters and house corporations as we begin the Fall 2021 academic year.

Real Talk Podcast – Emotional Support Animals: An Evolving Approach

This podcast episode contains an excerpt from our Housing Forum on the Road series discussing various approaches to Emotional Support Animals.

An Ounce of Prevention is Worth a Pound of Cure: How to Conduct an Internal Audit in 7 Steps to Avoid Wage and Hour Misclassification

Check out this resource to ensure that you have properly classified your employees.

Workers’ Compensation Case Study

Scenario The employee fell on the ramp outside the house and injured his leg. The insured disputed the employee’s injury because he was working the next day and was not limping. The injured employee then told the insured he would be off work because the doctor did not know the full extent of his injury […]

Coverage for an attorney serving as counsel for nonprofit organization

Memo describing how the coverage applies in these situations.

Best Practices for Background Checks

Best practices for incorporating background checks into your hiring process

What to consider when it comes an ill house director

Some risk management considerations if the House Director tests positive for COVID-19

Attracting and hiring talent assessment

Risk control doesn’t start when an employee begins work – it starts with the job itself. View Travelers’, the insurance company for MJ Sorority clients, collection of resources to help you attract and hire employees in your organization.

Digging Deeper: Non-Owned & Hired Automobile Coverage

Non-Owned Automobile Liability is the most commonly misunderstood coverage in the Sorority Book of Business. Non-Owned Automobile Liability is designed to protect the organization for the risk of being named in a lawsuit involving an automobile. It does not protect individuals who are driving on behalf of the Sorority/Fraternity. Non-Owned and Hired automobiles are automatically […]

Things to Know About Your Organization’s Automobile Policy

Check out the Insurance Summary for more detailed information about your organization’s automobile policy, but the below graphic has the top three things to remember: Here is a print-friendly PDF version.

Share the Road

By Travelers Risk Control We have all encountered scenarios in which other drivers make us shake our heads. People often are quick to accuse other drivers of being reckless, but if pressed, they may admit to sometimes driving recklessly themselves. If unsafe driving is everyone’s problem, what is the solution? Our safety professionals have put together […]

7 Common Car Accidents and How to Help Avoid Them

Let’s face it: accidents happen. And when they do, you might be looking at car repairs and injuries as well as possible increases to your insurance premium. Safe driving can go a long way in keeping you and your family safe and your premium in check. Here are seven common car accidents and tips on […]

10 Tips to Reduce Distracted Driving

More than 40,000 Americans died on the roads in 2016, the most significant increase in deaths over a two-year period in more than 50 years.1 Whether someone you love has been known to text and drive, or you have found yourself distracted behind the wheel, these tips can help avoid dangerous activity on the road. Stow […]

Increase in Phishing Claims

A recent increase in phishing scams and how you can protect yourself and your organization.

Press Release: Welcoming Kit Moorman

Help us welcome our new Director of Risk Management Education and learn more about Kit Moorman.

Arbitration

Arbitration is a formal method of dispute resolution. This resource explains why your organization should consider binding arbitration clauses in membership agreements.

News & Notes: April 2022

MJ Sorority’s monthly newsletter. This issue covers boiler inspections, increasing construction costs, spring chapter house inspection recommendations, and more.

Real Talk Podcast – Event Planning Series: Special Event Policies

This podcast discusses special event policies – what they are, when you need them, and more!

Real Talk Podcast – Unofficial Houses: What, why, and how

This podcast discusses the what, why, & how of unofficial chapter houses.

Real Talk Podcast – FAQs: Commercial Auto Insurance

This podcast discusses the basics of commercial automobile coverage.

COVID-19 Guidance for Fall 2021

Updated COVID-19 guidance for sorority chapters and house corporations as we begin the Fall 2021 academic year.

Real Talk Podcast: Risky Activities

This podcast episode discusses risky activities and why chapters should avoid them.

Real Talk Podcast: Special Edition Housing Forum Recap

This podcast episode recaps the 2020 MJ Housing Forum.

Real Talk Podcast – Event Planning Series: All About Liquor Liability

This podcast episode discusses all about liquor liability.

Real Talk Podcast – Emotional Support Animals: An Evolving Approach

This podcast episode contains an excerpt from our Housing Forum on the Road series discussing various approaches to Emotional Support Animals.

Liability Claim Example: Setting up for an event

A liability claim example on setting up for an event.

Liability Case Study: Unofficial Chapter House

A liability claim example on unofficial chapter houses.

Unofficial Chapter Houses

A position paper on unofficial chapter houses and the liability risk they pose.

Liability Case Study: Loaning the chapter house to a third party

A liability claim example on loaning the chapter to a third party.

Liability Case Study: Homecoming Float Claim

Scenario A member was injured while climbing onto the sorority’s homecoming float. The member was walking along side the float with other members. The float was towards the back of the parade and was starting to fall behind. The walkers were instructed to board the float to speed up the procession. While the member was boarding the float, the driver accelerated. The member was […]

Liability Case Study: Policy Infraction

Scenario A member was injured at a chapter event when she stepped on a piece of glass that was on the dance floor and sustained a laceration to her foot. There was a sign posted at the bar stating that no glass bottles were to be taken onto the dance floor. It was discovered that […]

Liability Case Study: Bus Incident

Scenario The chapter hired two buses to take their members and guests to and from an event. One bus had security, but the senior bus did not. On the senior bus, a fight broke out between two members’ boyfriends. One of the young men sustained a broken nose, as well as other facial fractures during […]

Directors & Officers: Membership Termination #2

Scenario After going through the organization’s appeal process in an attempt to have her membership reinstated, a former member filed a lawsuit alleging fraud and breach of contract. The lawsuit alleged that the organization failed to follow their own internal rules and procedures in terminating the plaintiff’s membership. Throughout the appeal process and the lawsuit, […]

Directors & Officers: Membership Termination

Scenario Two former members accused of hazing alleged that they were not given the required due process in their inappropriate dismissal from the organization. An actual lawsuit was not filed in the matter. A claim was submitted and the insurance carrier assigned defense counsel who worked with the claimants’ attorney to prove to him that […]

Athletic Programs: Playing it Safe

Athletic programs should incorporate risk control principles to mitigate risks.

Spring 2021: What We Have Learned About COVID-19

What we have learned about COVID-19 that will help you better prepare for spring 2021.

Coverage for an attorney serving as counsel for nonprofit organization

Memo describing how the coverage applies in these situations.

Using personal homes for chapter events

Memo discussing the use of individual homes for chapter events.

ChubbWorks Registration

Directions for setting up ChubbWords for national headquarter administrator.

Business Continuity Planning: Three-part training series

A three-part webinar series from Travelers, the insurance company for MJ Sorority clients, that reviews what is needed in a business continuity plan.

Campus Crisis Planning

A resource developed for universities from Travelers, the insurance company for MJ Sorority clients, much of which is applicable to sororities as well.

Communicating with the media

A resource from Travelers, the insurance company for MJ Sorority clients, with tips for communicating with the media during a crisis or emergency.

Educational Services Risk Management Guide

A risk management guide that provides an overview of many loss control topics for school administrators and sorority leadership.

Digging Deeper: Non-owned and hired automobile liability

Digging deeper into how the non-owned and hired automobile coverage works.

Position Paper: Designated Driver/Sober Sis Programs

MJ Sorority’s position on sober sis/designated driver programs.

Position Paper: FERPA’s Impact on Women’s Fraternities and Sororities

What does the Family Educational Rights & Privacy Act (FERPA) Mean for Us?

Position Paper: Liability Waivers & Template

Our risk management position on the use of liability waivers and our waiver template for our clients’ use.

Position Paper: Alumnae Board Members Playing a Dual Role (Local and National Roles)

Our position on dual roles for volunteers.

Digging Deeper: Non-Owned & Hired Automobile Coverage

Non-Owned Automobile Liability is the most commonly misunderstood coverage in the Sorority Book of Business. Non-Owned Automobile Liability is designed to protect the organization for the risk of being named in a lawsuit involving an automobile. It does not protect individuals who are driving on behalf of the Sorority/Fraternity. Non-Owned and Hired automobiles are automatically […]

Things to Know About Your Organization’s Automobile Policy

Check out the Insurance Summary for more detailed information about your organization’s automobile policy, but the below graphic has the top three things to remember: Here is a print-friendly PDF version.

Share the Road

By Travelers Risk Control We have all encountered scenarios in which other drivers make us shake our heads. People often are quick to accuse other drivers of being reckless, but if pressed, they may admit to sometimes driving recklessly themselves. If unsafe driving is everyone’s problem, what is the solution? Our safety professionals have put together […]

7 Common Car Accidents and How to Help Avoid Them

Let’s face it: accidents happen. And when they do, you might be looking at car repairs and injuries as well as possible increases to your insurance premium. Safe driving can go a long way in keeping you and your family safe and your premium in check. Here are seven common car accidents and tips on […]

10 Tips to Reduce Distracted Driving

More than 40,000 Americans died on the roads in 2016, the most significant increase in deaths over a two-year period in more than 50 years.1 Whether someone you love has been known to text and drive, or you have found yourself distracted behind the wheel, these tips can help avoid dangerous activity on the road. Stow […]

Collegiate Chapter Members and Chapter Advisors Serving on the Local House Corporation Board

MJ Sorority’s position on chapter members and advisors serving on local House Corporations.

What To Do In The Event of A Claim

When the unexpected happens, report your claim right away to put yourself in the surest position—and best enable us to help.

Boosting chapter house safety with biometrics

One of the most advanced and effective security solutions for chapter houses available today is biometric entry systems.

Summer Planning Bulletin

A special edition of the MJ Sorority News & Notes to help you make the most of the summer season.

Managing Your Roof

Learn more about mitigating damage to your roofs in this webinar with Bone Dry Roofing.

Smart Security Strategies for Chapter Houses

Watch this webinar to learn more about the new security technologies available.

Leak Protection Technology Webinar

Learn more about how leak protection can protect your chapter house from water damage.

Continuing Chaos in the Property Insurance Market

News & Notes article addressing the continued upheaval in the property insurance market.

Updating and Maintaining Your Chapter House Roof

As weather patterns continue to evolve, it is crucial for housing corporations to update their chapter house roofs to withstand the increasing intensity of wind and hail events. Convective storms in particular are a major cause for concern.

Why two-factor authentication is your best cyber defense

Learn more about two-factor authentification and why it is so important

The Prevalence of Check Fraud, and How to Protect Your Organization

Best practices to protect your chapter or house corporation from check fraud.

What are convective storms and why should we care?

Explanation of convective storms and their impact on chapter properties.

Expections for Properties in MJ Sorority Insurance Program

A checklist required for leased and vacant properties in the MJ Sorority Insurance Program.

Tips for Preventing Water Damage

In this resource, we share tips and strategies to effectively prevent water damage and safeguard the integrity of sorority chapter houses.

Utilizing Technology to Prevent Water Damage

Utilizing technology, such as smart leak detectors and water shut-off valves, alongside proactive maintenance, is crucial for minimizing water damage risks and safeguarding properties from costly insurance claims.

Winterizing Your Fire System Checklist

Winter can be a harsh season for fire protection systems. Use this checklist from Ryan Fireprotection of best practices for preparing your system for the winter.

Thanksgiving/Winter Break: Closing Checklist and Reminders

Ensure everything is in order at the chapter house for Thanksgiving break.

Preventing Check Fraud

We have seen a recent uptick in fraudulent check claims. In this article, we share some helpful tips to mitigate your risk.

News & Notes: September 2023

This edition of the MJ Sorority newsletter covers the following topics: property market insurance update, building a reserve fund, addressing check fraud , 2024 economic outlook, FAQs, and more.

The Perfect Storm: Navigating the Crisis in Property Insurance

The current state of the property insurance market demands a shift in the way insurance is approached, and this article explores why.

News & Notes: August 2023

This edition of the MJ Sorority newsletter covers the following topics: property market insurance update, back to school risk management resources, 2024 economic outlook, FAQs, and more.

Building and Using Insurance Reserves for Sustainability

More than ever, property owners and managers need to be building their cash reserves for future expenses.

News & Notes: June-July 2023

This edition of the MJ Sorority newsletter covers the following topics: property market insurance update, summer risk management resources, reviewing contract basics, and more.

News & Notes: April 2023

This edition of the monthly MJ Sorority newsletter covers the following topics: building projects, summer closing checklist, chapter house self-inspection form, sprinkler system update, Housing Forum replay with Marlon Gibson, PhD, cybersecurity webinar, what to look for when reviewing a contract FAQ, and more.

News & Notes: March 2023

This edition of the monthly MJ Sorority newsletter covers the following topics: spring weather resources, important update about sprinkler credit, risky activities, Housing Forum session from Dr. Marlon Gibson, mental heath webinar, FAQ about workers’ compensation, and more.

News & Notes: February 2023

This edition of the monthly MJ Sorority newsletter covers the following topics: highlights from the 2023 MJ Housing Forum, risk management advice for hail season, cybersecurity prevention, FAQ about passenger vans, and more.

News & Notes: January 2023

This edition of the monthly MJ Sorority newsletter covers the following topics: winter storm update, winter driving tips, FAQ about volunteer’s insurance recommendations, preventing frozen pipes, preventing slips and falls.

News & Notes: November 2022

This edition of the monthly MJ Sorority newsletter covers the following topics: flu season preparedness, embezzlement risk management and claims trends, string lights FAQ, and preventing kitchen fires.

Accessibility Audit

Addressing any liability concerns associated with an accessibility audit at the chapter house.

ADA and Sororities

How the Americans with Disabilities Act applies to women’s fraternities and sororities.

Hail and Wind Damage

Additional details on preventing and minimizing hail and wind damage to your chapter house.

News & Notes: October 2022

This edition of the monthly MJ Sorority newsletter covers the following topics: winter weather preparedness, Greek kitchen design trends webinar, required conditions under the crime policy, cyber security awareness month, and contracts FAQ.

News & Notes: June 2022

This issue covers summer reminders, the letter to member’s parents template, summer to do list, automobile liability graphic, and more.

News & Notes: April 2022

MJ Sorority’s monthly newsletter. This issue covers boiler inspections, increasing construction costs, spring chapter house inspection recommendations, and more.

Increasing Construction Costs & What It Means for You

What increasing construction costs mean for chapter house properties.

Real Talk Podcast: All About Waivers

This podcast discusses the basics of liability waivers, our position on waivers, and several FAQs on waivers.

Spring Chapter House Maintenance Tips

The milder days of spring are the perfect time to perform chapter house maintenance.

Real Talk Podcast – Unofficial Houses: What, why, and how

This podcast discusses the what, why, & how of unofficial chapter houses.

Top Water Damage Tips (Infographic)

Top tips to prevent and minimize water damage at the chapter house. Print this infographic for use in common areas of the chapter house.

Real Talk Podcast – Event Planning Series: All About Contracts

This podcast discusses insurance contracts.

COVID-19 Guidance for Fall 2021

Updated COVID-19 guidance for sorority chapters and house corporations as we begin the Fall 2021 academic year.

Real Talk Podcast: Digging into designated driver and sober sis programs

This podcast discusses MJ’s position on kids at the chapter house/premises.

Real Talk Podcast: Special Edition Housing Forum Recap

This podcast episode recaps the 2020 MJ Housing Forum.

Real Talk Podcast: Chapter Housing Lessons from Covid

These podcast episodes discuss COVID-19: planning events and chapter housing.

Real Talk Podcast – Emotional Support Animals: An Evolving Approach

This podcast episode contains an excerpt from our Housing Forum on the Road series discussing various approaches to Emotional Support Animals.

Liability Claim Example: Premises Claim / Parent Injury

A liability claim example on a premises/parent injury claim.

Wildfires: Planning Ahead

Recommended safety measures if your chapter is located in a wildfire-prone area.

Real Talk Podcast – FAQs: Commercial Kitchens

This podcast episode contains a discussion of FAQs regarding commercial kitchens.

House Corporation Inventory Checklist

A helpful Excel spreadsheet to help you take an inventory of House Corporation owned property.

Unofficial Chapter Houses

A position paper on unofficial chapter houses and the liability risk they pose.

Workers’ Compensation Case Study

Scenario The employee fell on the ramp outside the house and injured his leg. The insured disputed the employee’s injury because he was working the next day and was not limping. The injured employee then told the insured he would be off work because the doctor did not know the full extent of his injury […]

Property Case Study: Fire Escape

Scenario According to a report completed by the Chapter Advisor, there were three chapter members conversing about the fire escape outside the window of the second floor. One member, who admitted she had previously been out on the escape, showed the other two new members that it was possible to go out onto the fire […]

Property Case Study: Sprinklers/Water Damage

Scenario A sprinkler head in a closet on the second floor went off resulting in water damage to the first and second floor, as well as the basement. The exact cause of the sprinkler head going off is not able to be determined. It is believed that the heat in the closet may have been […]

Property Case Study: Kitchen Fire

Scenario A member was using a deep fryer in the kitchen to heat oil. The member walked away to another room, and the fryer caught the cabinet and microwave on fire. The fire damage was contained to the kitchen. However, there was smoke damage throughout the house. Result A total of $47,972.09 was paid out […]

Property Case Study: Attic Fire

Scenario A fire broke out in the attic of the chapter house from what they believe was some insulation that fell between the wall and flooring landing on some wires and ignited. The attic was not sprinklered and sustained all of the damage below. However, as the claims progress in the cleaning up and repairing […]

Property Case Study: Subrogation Example

Subrogation – the legal process by which an insurance company, after paying a loss, seeks to recover the amount of the loss from another party who is legally liable for it. Scenario An extensive fire occurred on the top floor and roof of the chapter facility resulting in a total claim amount of $1,379,877. Due to […]

Liability Case Study: Loaning the chapter house to a third party

A liability claim example on loaning the chapter to a third party.

Property Case Study: Fire Escape #2

Scenario At a fraternity chapter house that was hosting a party, Jane Doe, chapter member, went out a second-floor door to a fire escape platform and fell through the hole, which provided a ladder access to the ground. There had been a previous fall from this fire escape at the chapter house in question, and […]

Slip, Trip and Fall Risk Management

A guide to help reduce the risks of slips, trips and falls at your business and on your premises.

Avoiding influenza with good personal health habits

A guide on how to avoid influenza with good personal health habits.

Influenza Checklist for Chapter Houses

Influenza (Flu): reducing the risk of exposure in the chapter house.

Burn & Fire Safety

A study conducted to understand college students’ views and knowledge of burn and fire safety.

Automatic Sprinkler Toolbox

This guide provides the ways, whens and hows of installing an automatic sprinkler system.

Spring 2021: What We Have Learned About COVID-19

What we have learned about COVID-19 that will help you better prepare for spring 2021.

Important Terms for Housing Agreements

Important terms and conditions to be included in your housing agreement.

What to consider when it comes an ill house director

Some risk management considerations if the House Director tests positive for COVID-19

Questions for your university contacts about their COVID-19 response

Communication is key to handling COVID-19. We have developed a few questions that we think are important that chapter and house corporation officers discuss with their university contacts.

What to consider when it comes to quarantining ill members

Some risk management considerations when it comes to whether or not to quarantine ill members.

COVID-19 and Your Chapter House

MJ Sorority guidance for dealing with COVID-19 at the chapter house.

South Carolina Hurricane Guide

The South Carolina hurricane guide contains helpful and practical tips for all chapters in the path of a hurricane. Check their website for the most updated version.

Hurricane preparedness

Hurricane preparedness: preparation (long-term and as the hurricane approaches), during the hurricane, and after the hurricane.

Earthquake protection, preparation, response and recovery

Contrary to public perception, earthquake preparedness is not just an issue in California. This resource from Travelers, the insurance company for MJ Sorority clients, offers tips to help protect your business before, during and after an earthquake.

Natural disaster risk management guide

Get information on preparing for natural disasters such as earthquakes, floods, tornados, hurricanes, wildfires, etc. This resource from Travelers, the insurance company for MJ Sorority clients, discusses exposure assessment, protection, planning and preparation, response, and recovery.

Campus Crisis Planning

A resource developed for universities from Travelers, the insurance company for MJ Sorority clients, much of which is applicable to sororities as well.

Crisis planning and prevention

A guide developed by Travelers, the insurance company for MJ Sorority clients, to help you plan for the unexpected and explain why it is critical to do so.

Educational Services Risk Management Guide

A risk management guide that provides an overview of many loss control topics for school administrators and sorority leadership.

Tornado preparation and response

A tornado preparedness resource from Travelers, the insurance company for MJ Sorority clients.

Digging Deeper: Directors & Officers coverage

Digging deeper into how Directors and Officers Liability coverage works.

Medical marijuana

MJ Sorority’s position on state marijuana legislation’s impact at the chapter house.

Digging Deeper: Non-Owned & Hired Automobile Coverage

Non-Owned Automobile Liability is the most commonly misunderstood coverage in the Sorority Book of Business. Non-Owned Automobile Liability is designed to protect the organization for the risk of being named in a lawsuit involving an automobile. It does not protect individuals who are driving on behalf of the Sorority/Fraternity. Non-Owned and Hired automobiles are automatically […]

Things to Know About Your Organization’s Automobile Policy

Check out the Insurance Summary for more detailed information about your organization’s automobile policy, but the below graphic has the top three things to remember: Here is a print-friendly PDF version.

Increased Risk of Attic Fires & Ramifications

Using heat sensors to prevent fire claims in the attic.

What To Do In The Event of A Claim

When the unexpected happens, report your claim right away to put yourself in the surest position—and best enable us to help.

Certificates of Insurance: What and Why?

What is a Certificate of Insurance and why someone would need one from you.

Building/Renovation Projects: What To Look For

Engaging in a building or renovation project is an exciting, albeit stressful, endeavor. In addition to the hundreds of decisions regarding design, budget, decorating, and other items, there are insurance and risk management concerns to consider in order to protect the House Corporation and the organization from loss.